From Exclusion to Empowerment: A Digital Financial Revolution

Kenya stands as a global beacon of financial technology innovation, a nation where the humble mobile phone has become a powerful bank branch in the palm of every hand. This digital revolution, born from the foundational success of M-Pesa, has evolved far beyond simple money transfers. Today, a new wave of FinTech—spearheaded by digital loan and savings apps—is fundamentally reshaping what it means to access and manage money. For millions of Kenyans previously locked out of formal banking due to lack of collateral, physical distance, or thin credit files, these platforms promise instant inclusion. Yet, this unprecedented access comes with complex questions about cost, privacy, and financial health. This exploration delves into the dual-edged nature of this revolution, offering a roadmap for navigating it wisely.

The Unprecedented Benefits: Convenience, Credit, and Inclusion

The appeal of apps like Tala, Branch, Okash, and their counterparts is undeniable, solving real and urgent financial needs.

1. Instant, Collateral-Free Credit: The most transformative offering is access to unsecured, short-term loans, often approved in minutes. For a small business owner needing to restock inventory, a parent facing a sudden school fee deadline, or an individual covering an emergency medical bill, this speed is invaluable. It bypasses the lengthy paperwork, guarantor requirements, and physical branch visits of traditional banks.

2. Democratizing Financial Tools: These apps have mastered the art of simplicity. They leverage alternative data—from mobile money transaction history and call records to device usage patterns—to create instant credit scores. This means a young entrepreneur with a vibrant M-Pesa flow but no formal employment history can qualify for credit, a feat nearly impossible with a mainstream bank.

3. Frictionless Savings and Financial Management: Beyond loans, apps like M-Shwari, KCB-M-Pesa, and Chapaa have popularized micro-savings and goal-based investment. Features like locked savings (earning higher interest) and automated round-up savings (investing spare change from transactions) cultivate a savings culture with minimal effort, making financial growth accessible and habitual.

The Critical Pitfalls: The Hidden Costs of Convenience

However, the very features that make these platforms attractive also embed significant risks that users must vigilantly assess.

1. The Debt Trap of Astronomical Interest Rates: The most severe pitfall is the cost of credit. While often advertised as "facilitation fees," the Effective Annual Interest Rates (EAR) on many digital loans can range from 30% to an astounding over 150%. Borrowing Ksh 1,000 for 30 days and repaying Ksh 1,150 might seem manageable, but annualized, this cost becomes crippling. Easy rollovers and top-ups can quickly spiral users—especially those using loans for consumption, not income generation—into inescapable debt cycles.

2. The Credit Reference Bureau (CRB) Shadow: Defaulting on these loans, even by a day, often leads to an immediate negative listing with Kenya’s Credit Reference Bureaus. A black mark on your credit report can block access to future loans, including mortgages, car loans, and even employer background checks, with far-reaching consequences for years.

3. Data Privacy and Security Concerns: To build credit scores, these apps require extensive permissions—access to contacts, SMS, call logs, and device data. The question of how this sensitive data is stored, used, and potentially sold remains a pressing concern. Users essentially trade their personal data for credit access, a transaction whose long-term implications are still unfolding.

4. The Consumption vs. Investment Dilemma: The ease of access can blur the line between productive borrowing (for business or asset-building) and impulsive borrowing for lifestyle consumption. The latter erodes financial health without creating any future income to repay the debt.

Navigating Responsibly: A User’s Survival Guide

To harness the benefits while mitigating the risks, adopt a disciplined, informed approach.

1. Borrow for Productive Emergencies Only: Pause and ask: "Will this loan generate income or solve a true emergency?" Avoid using it for non-essential shopping, betting, or regular bills. Treat it as a financial tool, not an income supplement.

2. Decode the True Cost: Before accepting, calculate the total repayment amount and ask for the Effective Annual Rate (EAR). Compare this to alternatives like a SACCO loan or an emergency fund drawdown. If the EAR is above 20%, it should ring alarm bells.

3. Prioritize Repayment Above All: Set a repayment alarm. Consider these loans as urgent, high-priority debts. Defaulting is never an option due to the CRB ramifications.

4. Use Savings Features, Not Just Loans: Actively use the platforms' savings and investment lockers. The goal should be to build a personal buffer so you become a saver, not a perpetual borrower.

The Bigger Picture: FinTech vs. Traditional Banking & SACCOs

Digital loans are a tool, not a complete financial system. They should be compared to other options:

Traditional Banks: Better for large, secured loans (e.g., mortgages, car loans) at lower interest rates and for building a long-term banking relationship. They are slower and have stricter requirements.

SACCOs: The gold standard for disciplined saving and accessing larger, lower-interest loans. They require regular contributions and patience but offer unparalleled value and community-based accountability.

A healthy financial life uses each institution for its strength: digital apps for true, productive micro-emergencies; SACCOs for planned major expenses; and banks for long-term asset financing.

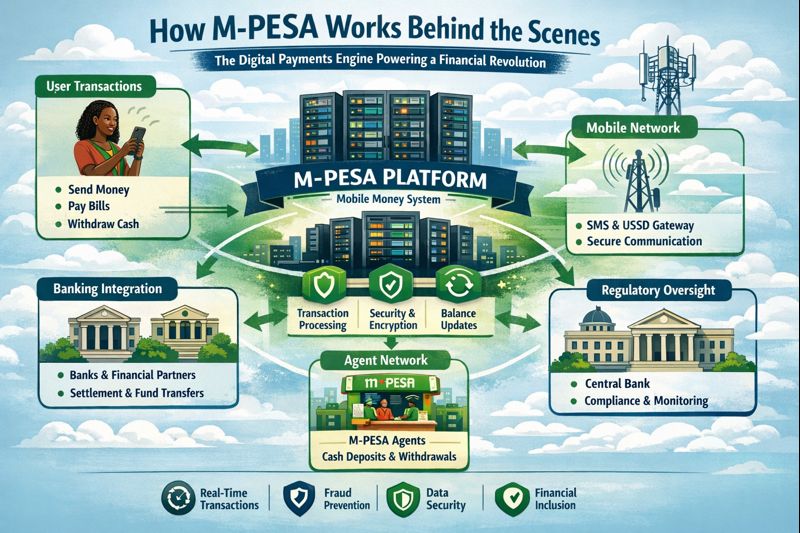

Regulation and the Future: The Role of the Central Bank of Kenya (CBK)**

Recognizing both the potential and perils, the CBK has stepped up regulatory oversight. Key interventions include:

Capping Digital Credit Charges: Setting maximum charges to protect consumers from predatory pricing.

Licensing All Digital Lenders: Requiring platforms to be formally licensed, improving transparency and accountability.

Strengthening Data Protection: Aligning with the Data Protection Act to guard user privacy.

Promoting Financial Literacy: Initiatives to educate the public on responsible digital credit use.

This regulatory framework aims to curb exploitation while fostering innovation that genuinely serves the public.

Conclusion: Empowerment with Eyes Wide Open

Kenya’s FinTech revolution has undeniably dismantled historic barriers to financial access, offering a powerful toolkit for economic participation. Yet, with great power comes great responsibility—both for the providers to offer ethical products and for the users to exercise disciplined judgment. The path forward is not to shun these tools but to engage with them intelligently. Use them to save diligently, borrow only for productive gain, and always read the fine print. By doing so, you transform the digital wallet in your hand from a potential debt trap into a genuine engine of financial resilience and growth, ensuring that the promise of FinTech leads to true and sustainable prosperity for all.