Navigating personal finance is a lifelong journey, but the terrain changes dramatically with each decade. The strategies that set you up for success in your freewheeling 20s won't suffice for the complex demands of your 40s. A proactive, decade-specific approach to financial planning is the most powerful tool you have to build security, achieve freedom, and prepare for a prosperous future. This comprehensive guide will map out the essential priorities, strategies, and mindset shifts needed to master your finances in your 20s, 30s, and 40s.

Financial Planning in Your 20s: Building the Foundation

Your 20s are a decade of immense transition—often launching a career, potentially managing student debt, and enjoying newfound independence. Financially, this decade isn't about having it all figured out; it's about establishing the core habits that will compound over time. The primary goal here is to build a strong, unshakable foundation.

Mastering Cash Flow and Conquering Debt

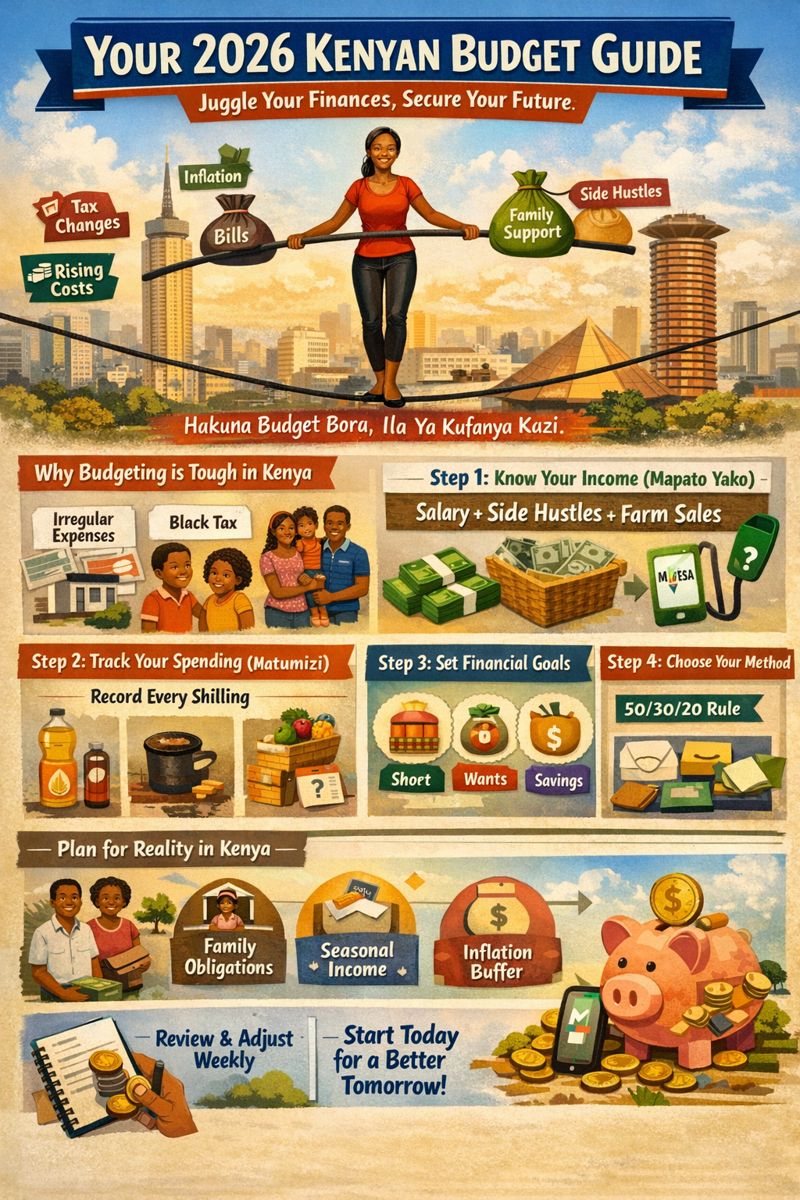

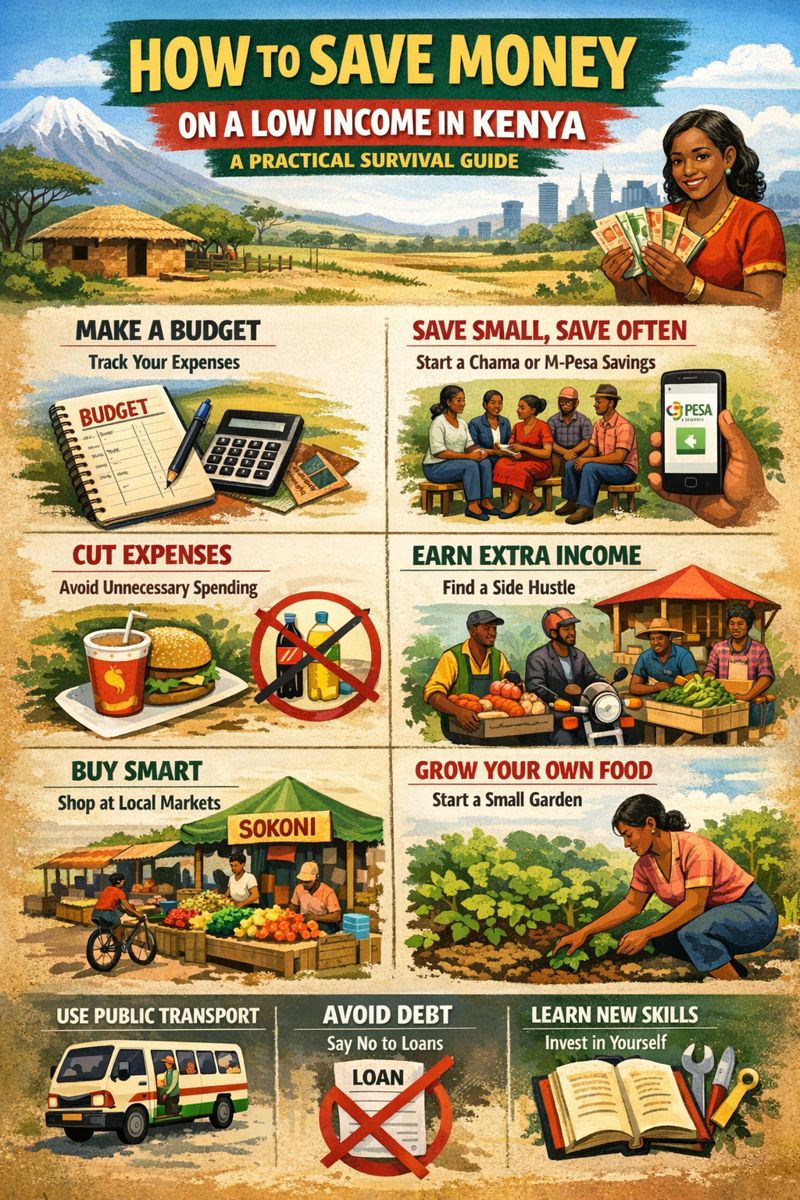

The first critical step is understanding your cash flow. Track your income and expenses diligently to see where your money is truly going. Create a realistic budget that aligns with your values, using the popular 50/30/20 rule as a starting point: 50% on needs, 30% on wants, and 20% on savings and debt repayment. The most pressing financial obstacle for many in their 20s is debt, particularly student loans. Develop a aggressive repayment strategy, whether it's the debt avalanche method (targeting high-interest debt first) or the debt snowball method (targeting small balances first for psychological wins). Avoid the trap of lifestyle inflation—as your income increases, direct the extra funds toward your financial goals, not just an upgraded lifestyle.

The Emergency Fund and the Retirement Head Start

Before aggressive investing, build your financial safety net. Aim to save an initial $1,000 emergency fund, then build it to cover 3-6 months of essential living expenses. This fund is your buffer against life's surprises, preventing you from falling into high-interest debt when unexpected costs arise. Simultaneously, start retirement savings now. The power of compound interest is your greatest ally in your 20s. If your employer offers a 401(k) or similar plan, contribute at least enough to capture the full employer match—it's free money. Open a Roth IRA if eligible; paying taxes now at your likely lower tax rate allows for decades of tax-free growth. Even small, consistent contributions made now will vastly outperform larger contributions made later in life.

Building Credit and Protecting Your Future Self

Establish and nurture a good credit history. Obtain a starter credit card, use it responsibly for small, regular purchases, and pay the statement balance in full every month. A strong credit score will save you tens of thousands of dollars over your lifetime on mortgages, auto loans, and insurance premiums. Finally, embrace a mindset of continuous financial education. Read books, follow reputable financial blogs, and learn about basic investing principles. Protect your income with renters insurance and understand your employee benefits. Your 20s are about planting seeds; you may not see the forest yet, but you're diligently planting every tree.

Financial Planning in Your 30s: Strategic Growth and Expansion

Your 30s often bring increased earnings, but also more significant responsibilities: marriage, homeownership, and potentially starting a family. Financial planning evolves from foundational habit-building to strategic growth and goal prioritization. The focus shifts to accelerating wealth accumulation while balancing competing financial demands.

Advancing Career and Supercharging Savings

This is typically your peak wealth-building decade. Focus on maximizing your earning potential through career advancement, skills development, or strategic job changes. As your income grows, resist complacency. Aggressively increase your retirement contributions, aiming to save 15-20% of your gross income. Max out your 401(k) and IRA contributions if possible. This is also the time to expand your investment portfolio beyond retirement accounts. Consider opening a taxable brokerage account for additional goals and explore diversifying into different asset classes.

Navigating Major Life Purchases

Two of life's largest financial decisions often occur in this decade: buying a home and having children. For homeownership, ensure you are financially ready—with a strong credit score, a stable down payment (ideally 20% to avoid Private Mortgage Insurance), and a budget that includes not just the mortgage but also property taxes, insurance, maintenance, and repairs. If starting a family, immediately begin estimating the costs: healthcare, childcare, education savings, and adjusted insurance needs. Open a 529 college savings plan early to leverage time and compounding for your child's future education.

Risk Management and Estate Planning

With growing assets and dependents, risk management becomes non-negotiable. Review and upgrade your insurance coverage: secure a 20-30 year level term life insurance policy, ensure your disability insurance is robust, and review your property and auto insurance limits. Crucially, establish basic estate planning documents. This includes a will (to dictate asset distribution and guardianship for children), a financial power of attorney, and an advance healthcare directive. These documents are acts of responsibility, not morbidity. Your 30s are about building your financial fortress—making strategic moves to grow your wealth while installing sturdy defenses to protect what you're building.

Financial Planning in Your 40s: Consolidation and Acceleration

Entering your 40s, retirement shifts from a distant concept to a visible horizon, perhaps 15-20 years away. This decade is characterized by peak earning years but also potential financial pressures like funding teens' activities, caring for aging parents, and managing a larger household. The financial planning mantra for your 40s is consolidation and acceleration.

Conducting a Financial Midpoint Review

Take a comprehensive inventory of your entire financial landscape. Calculate your net worth in detail. Analyze your investment portfolio's asset allocation—is it still appropriate for your time horizon and risk tolerance? As retirement nears, a gradual shift toward a slightly more conservative allocation may be prudent, but avoid being too conservative too soon, as you may still have 30+ years of life ahead in retirement. Perform a rigorous "fee audit" on your investment accounts; high fees erode compounding. Consolidate old 401(k) accounts into an IRA or your current employer's plan to simplify management.

The Dual Focus: Aggressive Retirement Saving and Other Goals

You are in your final decade of truly aggressive retirement saving before the traditional pre-retirement years. Maximize all tax-advantaged accounts (401(k), IRA, HSA) and utilize catch-up contributions (available starting at age 50). At the same time, you may be in the "sandwich generation," simultaneously saving for retirement, helping children with college costs, and potentially assisting aging parents. Transparent family conversations about what you can and cannot afford to contribute are essential. Prioritize your retirement; you can take loans for college, but not for retirement.

Debt Elimination and Income Diversification

A critical goal for this decade should be entering your 50s as debt-free as possible. Develop a focused plan to pay off your mortgage early or eliminate other high-interest debts. This dramatically reduces your monthly financial burden heading into retirement. Additionally, explore avenues for diversifying your income. Could a hobby generate side income? Can you invest in real estate or other cash-flowing assets? Developing multiple income streams builds resilience and can accelerate your path to financial independence. Your 40s are about pressing hard on the accelerator toward retirement while ensuring the financial vehicle is tuned, efficient, and on the right path.

The Unifying Threads: Mindset and Adaptability

While each decade has distinct priorities, several principles are universal. First, live below your means. This is the engine of savings and the buffer against uncertainty in every life stage. Second, automate your finances. Set up automatic transfers to savings, investment, and debt accounts to ensure consistency and remove temptation. Third, continuously educate yourself. The financial world evolves, and so do your personal circumstances. Finally, practice adaptability. Life will throw curveballs—job loss, market downturns, health issues. A solid financial plan is not rigid; it's a flexible guide that you adjust as needed.

The journey of financial planning is a marathon run in three distinct sprints. By focusing on the right priorities at the right time—building habits in your 20s, executing strategy in your 30s, and consolidating gains in your 40s—you create a powerful momentum. Start today, regardless of your age. The best time to plant a tree was 20 years ago; the second-best time is now. Take control of your financial narrative, one deliberate decade at a time, and build the future of security and choice you deserve.