Saving KSh 100,000 in a single year might seem like a daunting task, especially with the rising cost of living in Kenya. However, with careful planning, discipline, and a strategic approach, this financial goal is entirely achievable for many earners. Breaking it down, KSh 100,000 per year translates to approximately KSh 8,333 per month, KSh 2,740 per week, or KSh 385 per day. This guide provides a detailed, actionable roadmap to help you build this significant savings pot, one shilling at a time.

Mindset Shift: The Foundation of Successful Saving

Before diving into the numbers, you must cultivate a "savings-first" mindset. Instead of saving what's left after spending, you must spend what's left after saving. This psychological shift is your most powerful tool. Visualise your goal: Is it a down payment for land? A car? An emergency fund? An investment stake? Keeping this "why" clear will fuel your discipline on difficult days.

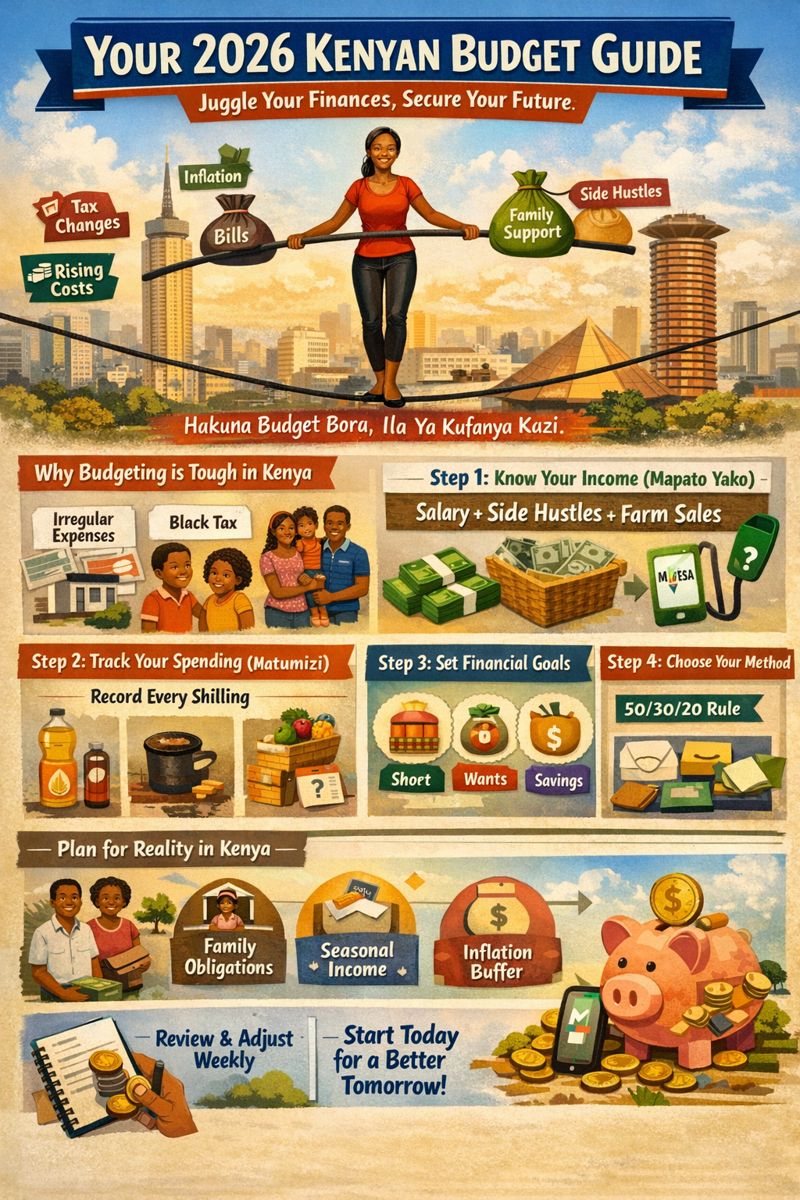

Step 1: Conduct a Financial Health Check (Month 1)

You cannot manage what you don't measure.

Track Every Shilling: For one month, record every single expense—from your rent to that KSh 50 mandazi. Use a notebook, a spreadsheet, or a budgeting app like Money Lover, Goodbudget, or your bank’s app.

Categorise Expenses: Group your spending into:

Fixed Essentials: Rent, Loan Repayments, Insurance, Basic Utilities (Electricity, Water), School Fees.

Variable Essentials: Food, Transport, Airtime/Data.

Non-Essentials (Discretionary): Eating out, Entertainment, Premium TV subscriptions, Impulse buys.

Analyse the Leakage: At month's end, review. You’ll likely find "money leaks" in the Non-Essentials category. Those daily lattes, unplanned taxi rides, and unsubscriptioned SMS bundles add up significantly.

Step 2: Create a Realistic, Goal-Oriented Budget

Now, build a budget that prioritises your KSh 8,333 monthly saving.

The 50/30/20 Rule (Adjusted for Kenya):

50% on Needs (Essentials): Aim to keep your fixed and variable essentials within half of your take-home pay.

30% on Wants (Non-Essentials): This is your lifestyle spending. The goal is to shrink this to create more room for savings.

20% on Savings & Debt Repayment: This is your target zone. Your KSh 8,333 should come from here. If you have high-interest debt (like mobile loans), allocate part of this 20% to clear it first, as the interest erodes your saving capacity.

Sample Budget for a Net Income of KSh 50,000:

Income: KSh 50,000

Needs (50% = KSh 25,000): Rent (12,000), Food (7,000), Transport (4,000), Utilities/Airtime (2,000).

Savings Goal (20% = KSh 10,000): KSh 8,333 to your "100K Goal" account, KSh 1,667 to an emergency fund or debt repayment.

Wants (30% = KSh 15,000): This is what you have left for everything else. By being mindful here, you can potentially channel even more to savings.

Step 3: Strategic Cutting: Where to Find the KSh 8,333 Per Month

Here are practical, Kenya-specific areas to trim expenses:

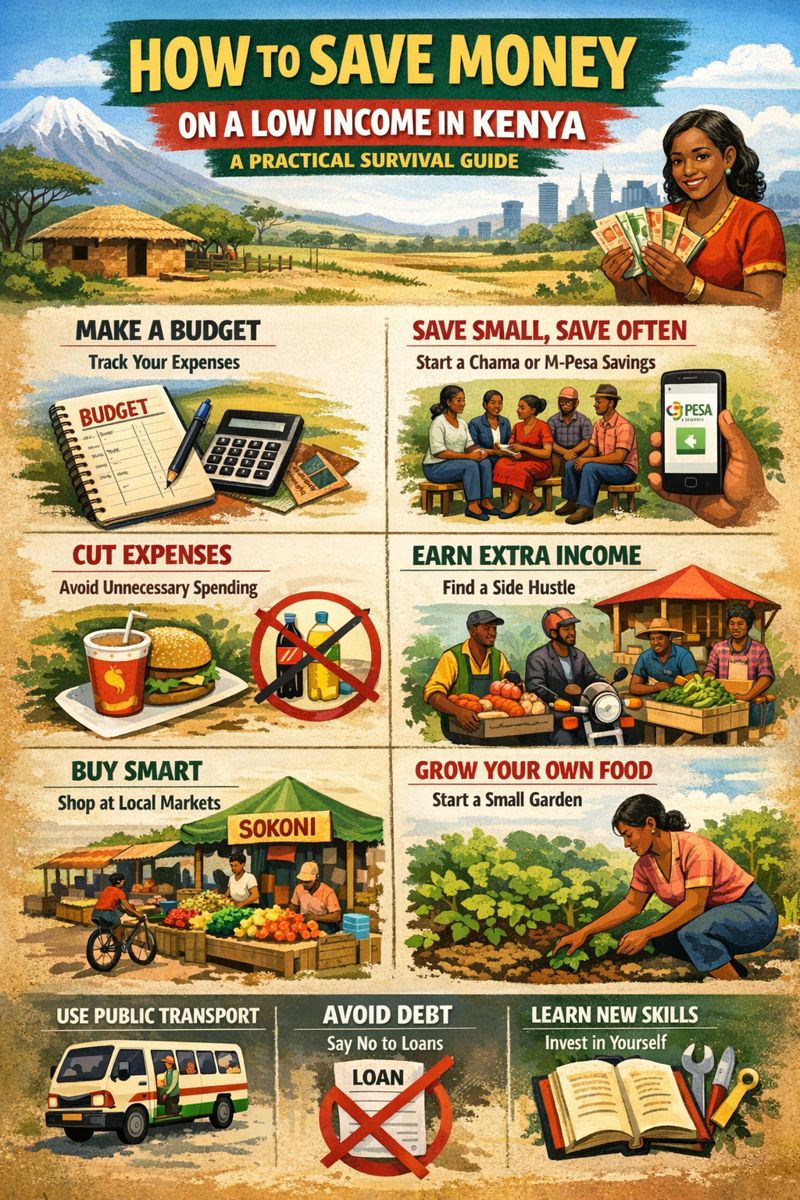

1. Food (Often the Biggest Flexible Expense):

Plan Weekly Menus & Bulk Shop: Buy staples like maize flour, rice, and beans in larger quantities from markets or wholesalers (like Naivas Hyper or Carrefour on offer days).

Cook at Home: Prepare lunch boxes. Eating out for KSh 300 daily costs KSh 6,600 monthly. Home-cooked meals can cut this by over 60%.

Leverage Local Markets: Buy fresh vegetables and fruits from your local mama mboga or open-air market for better prices than supermarkets.

2. Transport:

Use Public Transport Strategically: If you use a personal car, consider using matatus for some days to save on fuel, parking, and wear-and-tear. A car can easily cost KSh 15,000+ monthly.

Carpool: Share rides with colleagues heading the same direction.

Walk Short Distances: Improves health and saves money.

3. Airtime, Data, and Subscriptions:

Switch to Bundles & WiFi: Use monthly data bundles instead of daily top-ups. Use office or home WiFi whenever possible. Audit your mobile money transaction fees.

Cut Unused Subscriptions: Do you really need all those DSTV/GOTV bouquets? Consider switching to more affordable streaming services or using free local channels.

4. Housing & Utilities:

If Possible, Get a Housemate: Splitting rent and utilities can instantly free up thousands.

Conserve Energy: Use energy-saving bulbs, switch off appliances at the plug, and air-dry clothes instead of using a dryer.

Use Water Sparingly: Fix leaky taps immediately.

5. Lifestyle & Entertainment:

Embrace Free/Cheap Fun: Explore parks, free museum days, hiking, and hosting friends at home instead of going to expensive clubs or restaurants.

The 24-Hour Rule: For any non-essential purchase over KSh 1,000, impose a 24-hour waiting period to avoid impulse buys.

Step 4: Automate & Separate Your Savings

"Out of sight, out of mind" is the savers' mantra.

Open a Dedicated Savings Account: Use a different bank from your main account or a mobile savings product like:

M-Shwari Lock Savings Account

KCB M-Pesa Goal Account

Equitel’s EazzySave

Commercial Bank Goal-Oriented Savings Accounts

Set Up Automatic Transfers: Immediately after receiving your salary or any income, set an automatic standing order to transfer KSh 8,333 directly to your dedicated savings account. This ensures you save before you even have a chance to spend.

Step 5: Boost Your Income

Cutting costs has limits, but increasing your income has more potential.

Monetise a Skill: Use your evenings or weekends. Are you good at writing, graphic design, coding, tailoring, or baking? Offer your services on platforms like Fiverr, Upwork, or locally via social media.

The Gig Economy: Drive for Uber/Bolt in your free time, do deliveries for Glovo or Uber Eats.

Sell Unused Items: Turn clutter into cash on Facebook Marketplace or Jiji Kenya.

Part-Time Work: Consider part-time tutoring, consultancy, or sales.

Step 6: Monitor, Adjust, and Stay Motivated

Review Monthly: Check your budget vs. actual spending. Celebrate when you hit your monthly target! If you fall short, analyse why and adjust for the next month without giving up.

Find an Accountability Partner: Share your goal with a trusted friend or family member who can encourage you.

Visualise Your Progress: Use a savings tracker chart. Watching the number grow is immensely satisfying.

Where to Park Your Growing Savings

Don't just save; make your money work a little. Consider low-risk, accessible options:

High-Yield Savings Accounts: Some banks and SACCOs offer accounts with better interest rates than regular savings accounts.

Money Market Funds: Offered by most fund managers (e.g., CIC, Britam, Sanlam), they offer better returns than banks with high liquidity. You can start with as little as KSh 1,000.

SACCO Deposits: Joining a reputable SACCO allows you to save and earn competitive dividends annually. Your savings can also make you eligible for low-interest loans in the future.

Conclusion: The Journey of a Thousand Miles

Saving KSh 100,000 in a year is not about drastic deprivation; it’s about consistent, mindful choices. It’s about choosing ugali and beans at home a few more times a week, negotiating that boda boda fare, and finding joy in financial growth. The discipline you build and the financial security you create will be worth far more than the KSh 100,000 itself. Start today. Set up that standing order for your first KSh 8,333. Your future self will thank you for the peace of mind and the opportunities this seed capital will unlock.

Take Action Now: Open a new mobile savings account on your phone, label it "100K GOAL," and make your first deposit right now, no matter how small. You've just taken the most important step