Understanding the CRB Credit Score: The Foundation of Your Financial Reputation in Kenya

In Kenya's rapidly evolving financial landscape, your Credit Reference Bureau (CRB) score has become one of the most critical components of your financial identity. Whether you're applying for a loan, seeking a mortgage, or even exploring certain employment opportunities, this three-digit number can significantly impact your financial possibilities and terms.

A CRB score, typically ranging from 200 to 900, represents your creditworthiness based on your historical financial behavior. Understanding how to improve your CRB score isn't merely about fixing past mistakes—it's about establishing sustainable financial habits that open doors to better interest rates, higher credit limits, and enhanced financial flexibility.

This comprehensive guide will walk you through actionable strategies, common misconceptions, and long-term practices to not only repair but continuously enhance your credit standing with Kenyan credit bureaus.

How CRB Scores Are Calculated: The Five Key Factors

Before embarking on improvement strategies, you must understand what factors influence your score. Kenyan credit bureaus—primarily TransUnion, Creditinfo, and Metropol—evaluate several components:

Payment History (35%): This is the most significant factor. It reflects whether you've paid past credit accounts on time. Late payments, defaults, and listed debts (commonly known as "blacklisting") severely damage this component.

Credit Utilization (30%): This measures how much of your available credit you're using. High balances relative to your credit limits suggest financial strain and negatively impact your score.

Length of Credit History (15%): A longer credit history generally improves your score, as it provides more data on your financial behavior. This considers the age of your oldest account, newest account, and average age of all accounts.

Credit Mix (10%): Having a diverse range of credit types (installment loans, credit cards, mobile loans, etc.) can be beneficial, demonstrating your ability to manage different forms of credit responsibly.

New Credit (10%): Frequently applying for new credit within a short period can lower your score, as it may indicate financial distress or risky behavior.

Understanding this weighting system allows you to prioritize your efforts effectively, focusing first on the most impactful areas: payment history and credit utilization.

Step 1: Obtain and Scrutinize Your Credit Report

You cannot improve what you do not measure. The first and most crucial step is to obtain your credit report from all three major Kenyan CRBs. By law, you are entitled to one free credit report per year from each bureau. Visit their offices or websites:

TransUnion Kenya: Located in Westlands, Nairobi, or via their online portal.

Creditinfo Kenya: Has offices in Nairobi.

Metropol CRB: Offers services across various branches.

When you receive your report, examine it meticulously for:

Inaccuracies: Incorrect personal details, accounts that aren't yours, or payments marked late that you paid on time.

Duplicate Listings: Sometimes the same debt is listed multiple times.

Outdated Information: Negative information should generally not remain on your report for more than 5 years.

"Full Settlement" vs. "Write-Off": Ensure any cleared debt is accurately reported as "settled in full" rather than the more damaging "written off."

If you find errors, you have the right to dispute them. File a formal dispute with the respective CRB, providing supporting documents like payment receipts or bank statements. The bureau is obligated to investigate and correct verified inaccuracies, often within 14-30 days.

Step 2: Address Existing Defaults and Negative Listings

If your report shows defaults or you've been "blacklisted," this is your primary battlefield. Negative listings remain for five years, but you can change their status from negative to neutral.

Strategy 1: Full Settlement and Clearance Certificate

Contact the lender you defaulted with and negotiate to pay the outstanding amount. Once paid, obtain a Clearance Certificate or Payment Confirmation Letter. This document is crucial. Submit it to the CRB where you are listed, requesting an update of your status to "settled." While the listing will remain for five years from the default date, its status will change, significantly reducing its negative impact.

Strategy 2: Partial Settlement and "Wakala" Services

If you cannot afford the full amount, negotiate a partial settlement. Some lenders accept a lump sum that is less than the total owed to close the account. Get any agreement in writing before payment. Be wary of "CRB clearance agents" or "wakala" services promising instant removal for a fee. No one can legally remove accurate negative information before its five-year term. Legitimate services can only help you navigate the settlement and update process.

Strategy 3: The "Right of Reply"

You have the right to add a 200-word statement to your credit report explaining any default. For instance, "This default occurred due to prolonged hospitalization in 2021. All payments have since been regularized." While it doesn't remove the listing, it provides context to future lenders.

Step 3: Master the Art of Timely Payments

Future behavior is the most powerful tool for score improvement. Consistent, on-time payments have the single greatest positive impact.

Automate Everything: Set up standing orders or direct debits for all minimum payments on loans, credit cards, and even utility bills if they're reported to CRBs (some are). This eliminates the risk of forgetfulness.

Prioritize by Amount and Recency: If you have multiple debts, prioritize payments on the largest balances and the most recent accounts. Recent late payments hurt more than older ones.

Communicate Proactively During Hardship: If you face genuine financial difficulty (job loss, medical emergency), contact your lenders before missing a payment. Many have hardship programs allowing for restructured payments, which may not be reported as a default if agreed in advance.

Step 4: Strategically Manage Your Credit Utilization

Aim to use less than 30-35% of your total available credit limit at any given time. High utilization suggests over-reliance on credit.

Increase Your Limits, Not Your Spending: If you have a credit card with a Ksh 100,000 limit and consistently use Ksh 80,000, you're at 80% utilization. Requesting a limit increase to Ksh 200,000 while maintaining the same Ksh 80,000 balance immediately drops your utilization to a healthy 40%. Crucially, do not increase your spending after the limit increase.

Make Multiple Payments Per Month: If you use credit cards frequently, make payments twice a month instead of once. This keeps the balance reported to CRBs (usually your statement balance) low.

Keep Old Accounts Open: Even if you don't use an old credit card, keeping it open increases your total available credit, lowering your overall utilization ratio. Use it for a small, recurring subscription and set up auto-pay.

Step 5: Build a Positive Credit History Through Strategic Borrowing

A common myth is that having no debt gives you a perfect score. In reality, you need a history of responsible debt management to build a high score.

Start Small with a Digital Loan or Retail Credit: If you have a thin file, consider a small, manageable mobile loan (like from M-Shwari or KCB M-Pesa) or retail store credit. Borrow a small amount and repay it early. The key is demonstrating repeated, responsible repayment.

Consider a Secured Credit Builder Loan: Some financial institutions offer loans where the money is held in a locked savings account while you make payments. After completing payments, you receive the funds plus interest. It's a low-risk way to build a payment history.

Become an Authorized User: If a family member with an excellent credit history adds you as an authorized user on their credit card, the positive payment history of that account can potentially boost your own file. Ensure the lender reports authorized user activity to the CRBs.

Step 6: Cultivate Smart Credit Application Habits

Every formal credit application results in a "hard inquiry" on your report. Too many in a short period (e.g., 6-12 months) signals desperation and can lower your score.

Space Out Your Applications: Avoid applying for multiple loans or cards within a short timeframe. Do your research first and only apply for credit you genuinely need and are likely to get.

Pre-Qualify Where Possible: Some lenders offer pre-qualification checks using a "soft inquiry," which doesn't affect your score. This allows you to see potential offers without the negative impact.

Beware of "Loan Shopping": When rate shopping for a specific loan type (e.g., a mortgage), try to complete all your applications within a focused 14-30 day period. CRBs often count these as a single inquiry for scoring purposes.

Long-Term Maintenance: The Habits of High-Score Individuals

Improving your score is a marathon, not a sprint. Long-term maintenance requires embedding key habits into your financial life.

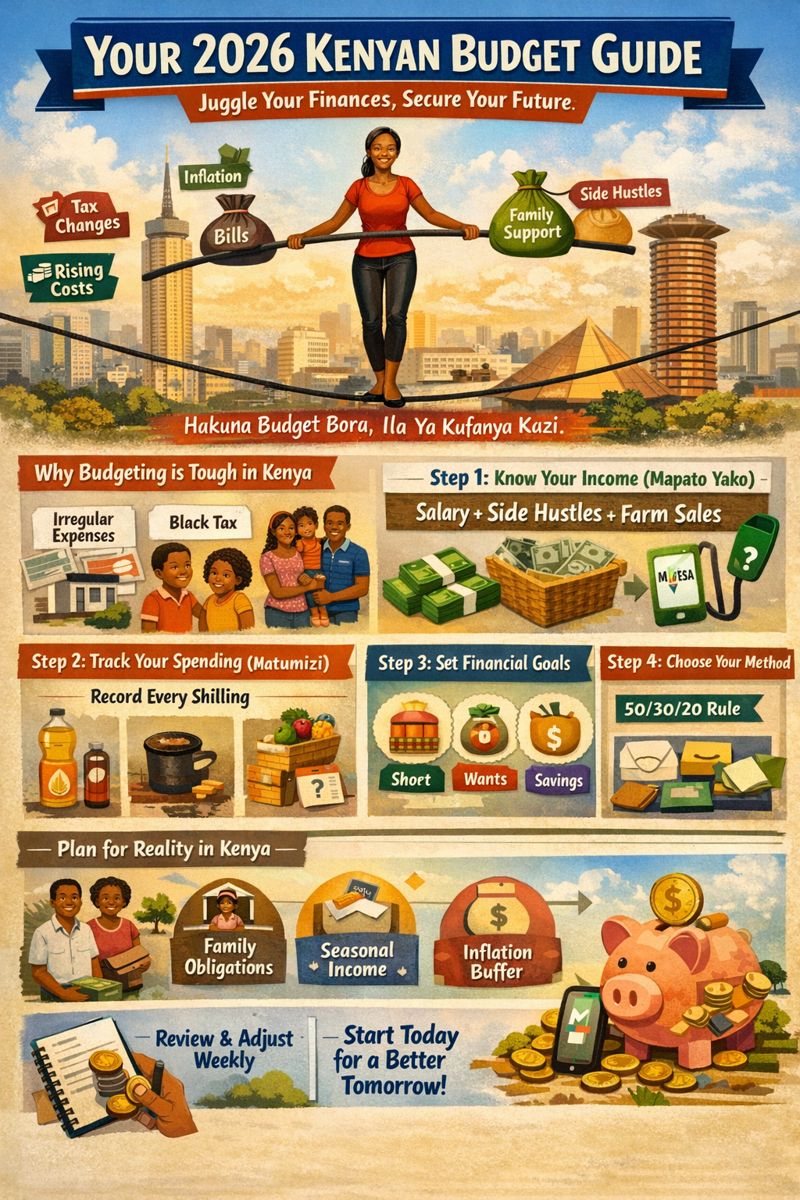

Create and Adhere to a Realistic Budget: Use the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt repayment) or a similar framework. A budget prevents you from overextending and missing payments.

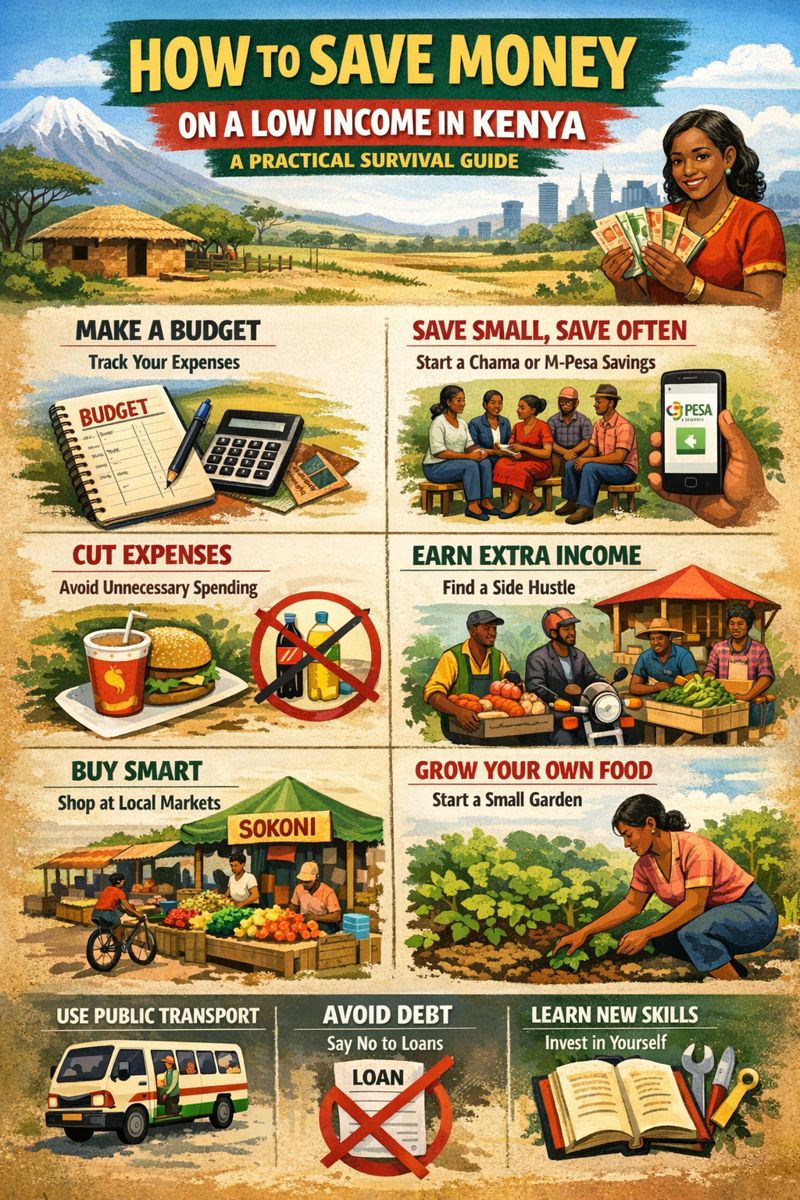

Build an Emergency Fund: Strive to save 3-6 months' worth of living expenses. This fund acts as a buffer, preventing you from needing high-cost emergency credit that could lead to default.

Monitor Your Score Regularly: Don't wait for your annual free report. Consider affordable credit monitoring services that alert you to significant changes, helping you detect fraud early and track your progress.

Diversify Your Credit Wisely Over Time: As your score improves, consider a mix of credit—a major credit card, an installment loan (like a car loan), and perhaps a checking account overdraft facility. Manage all with impeccable discipline.

Special Considerations for Kenyan Borrowers

The Kenyan market has unique facets that require specific strategies:

Mobile Loan Apps: Apps like Tala, Branch, and Okolea report to CRBs. While convenient, their high-frequency reporting means a late payment is quickly reflected. Use them sparingly and repay immediately. Their small limits also mean it's easy to max out, hurting your utilization.

SACCO Loans: Loans from Savings and Credit Cooperatives are often reported. The good standing within your SACCO can be a strong positive on your report.

Utility and Rent Reporting: While not yet universal, some property managers and utilities are beginning to report payment data. Proactively ask if your on-time rent payments can be reported to build positive history.

The "Blacklist" Misconception: There is no permanent "blacklist." It's a negative listing with a finite lifespan. Focus on the updateable status (from default to settled) rather than the myth of permanent financial exile.

Navigating Setbacks and Protecting Your Score

Life happens. If you encounter a setback:

1. Don't Ignore It: Defaults compound with fees and penalties. Engage with the lender immediately.

2. Prioritize Necessities: If you must choose, prioritize secured debts (like a logbook loan where the asset can be repossessed) and necessities like rent.

3. Seek Financial Counseling: Organizations like the Kenya Institute of Credit Management (KICM) offer guidance on debt management and financial planning.

Guard Against Identity Theft: Secure your personal documents (ID, KRA pin). Regularly check your report for accounts you didn't open. In Kenya, you can place a protective flag on your credit file if you suspect fraud.

Conclusion: Your CRB Score as a Reflection of Financial Wellness

Improving your CRB score is a profound exercise in financial discipline and foresight. It begins with confronting your current financial reality through your credit report, strategically addressing past negatives, and systematically building a future of impeccable financial behavior. The journey from a low score to a strong one can take months or even years, but every on-time payment, every corrected error, and every wisely managed credit line is a brick in the foundation of your financial reputation.

Remember, a high CRB score is not an end in itself. It is a tool—a key that unlocks lower borrowing costs, greater financial opportunities, and, ultimately, peace of mind. In Kenya's credit-driven economy, taking control of your credit score is one of the most powerful steps you can take toward long-term financial security and achieving your personal and entrepreneurial goals. Start today by ordering your free report, and commit to the steady, disciplined process of building a score that truly reflects your financial responsibility.