In the vibrant economic landscape of Kenya, where mobile money reigns and opportunities abound, a critical question stalls the journey to wealth for many: Should I save or invest first? With competing goals—from building an emergency fund to chasing returns on the Nairobi Securities Exchange (NSE) or in government bonds—the wrong step can mean financial stress instead of growth. The truth is, neither saving nor investing is universally "better." Your financial security hinges on mastering the sequence. For Kenyans, getting this order right isn't just smart; it's the foundation for surviving economic shifts and building lasting prosperity.

Understanding the Core Difference: Your Safety Net vs. Your Growth Engine

First, let's define these pillars in the Kenyan context.

Saving is setting aside money in safe, easily accessible places with minimal risk of loss. The primary goal is capital preservation for short-term needs. In Kenya, this typically means:

M-Shwari or KCB M-Pesa Lock Savings: Offering around 3-5% annual interest, with instant access.

Bank Savings Accounts: Low-interest, highly liquid accounts.

SACCO (Savings and Credit Co-operative Society) Deposit Accounts: Often offering better returns than banks (e.g., 5-8%) with good security, though access may have slight delays.

Savings are your financial shock absorbers. They protect you from unexpected medical bills, sudden car repairs, or a period of unemployment without forcing you into high-interest debt from digital lenders.

Investing is committing money to assets with the expectation of generating higher returns over a longer period, but with the acceptance of risk. The goal is wealth creation that outpaces inflation (which averaged 6.7% in 2023). Kenyan investment avenues include:

Government Bonds & Treasury Bills: Considered low-risk, offering returns that generally beat inflation (e.g., 10-15% for T-bills recently).

The Nairobi Securities Exchange (NSE): Buying shares of companies for potential capital gains and dividends.

Real Estate: Land and property, a traditionally trusted asset class.

Unit Trusts & Mutual Funds: Managed portfolios offering diversification.

Investing is your wealth engine. It’s how you build assets that work for you, turning saved capital into a larger future sum.

The Golden Rule for Kenyans: Why Saving Must Come First

For the vast majority, saving is the non-negotiable first step. Here’s why this sequence is crucial in Kenya’s environment:

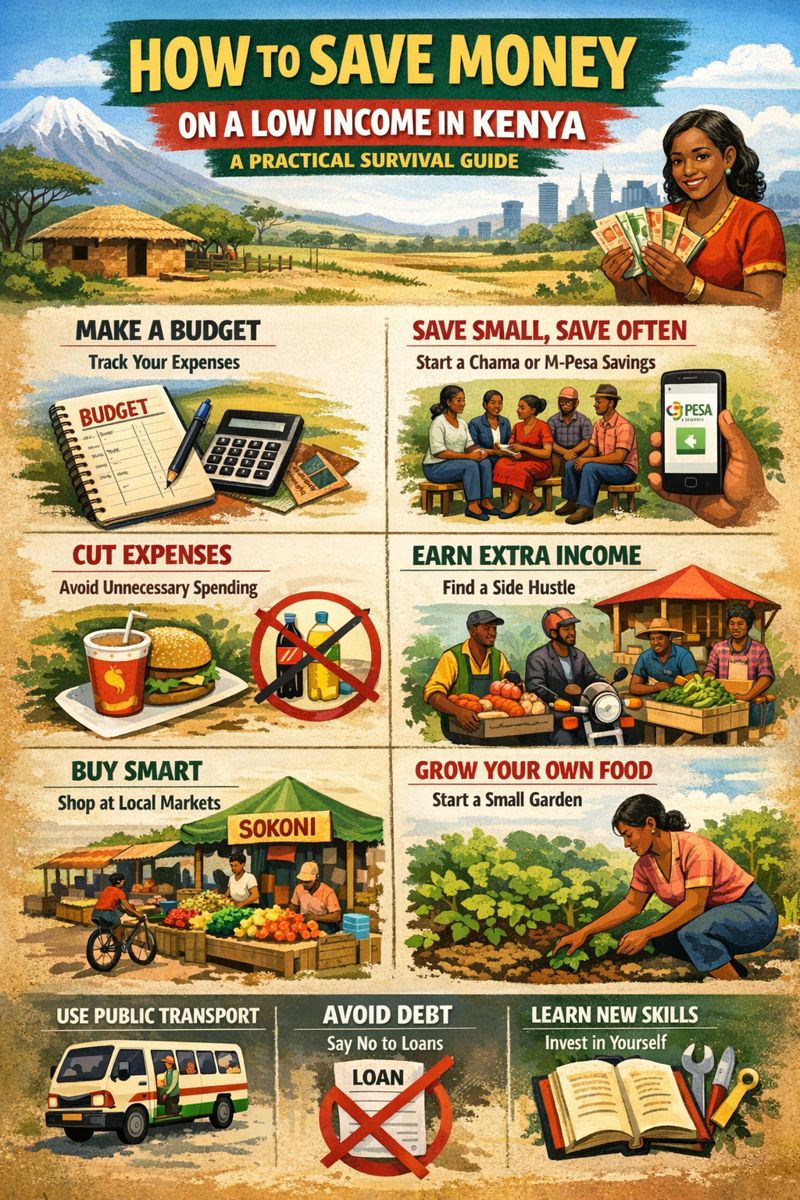

1. Taming the Debt Dragon: Kenya's household debt is significant, with many turning to quick, high-interest loans for emergencies. A robust savings pot acts as a self-insurance policy, preventing you from borrowing at punitive rates from shylocks or digital loan apps when life happens. You cannot invest effectively if you are constantly paying off high-interest debt.

2. Building Your Financial Runway: Start with an Emergency Fund. Financial advisors recommend saving 3-6 months' worth of essential living expenses (rent, food, utilities, school fees). Given the gig economy and contractual job nature, aim for the higher end. Park this fund in a high-liquidity option like a dedicated M-Shwari savings account—not tied up in investments you can't quickly access.

3. Creating Capital to Invest: You need money to make money. A disciplined savings habit accumulates the capital you will later deploy into investments. Trying to invest with your last shilling is a recipe for panic selling during market dips.

When Can a Kenyan Start to Invest?

Once you have your emergency fund firmly in place, you can strategically begin investing. Follow this actionable roadmap:

Step 1: Secure Your Foundation. Ensure your emergency savings are complete. This is your financial bedrock.

Step 2: Define Clear Goals. Are you investing for:

A house down payment in 5 years? (Medium-term, lower-risk investments like bonds may suit).

Your child’s university education in 10 years? (A mixed portfolio).

Retirement in 25 years? (Long-term, can tolerate more NSE volatility for higher growth).

Step 3: Start Small & Educate Yourself. You don’t need Ksh 500,000 to start.

Explore the M-Akiba bond, which allows investment from as low as Ksh 3,000 via your phone.

Consider Unit Trusts with initial investments as low as Ksh 1,000.

Use NSE simulation apps to learn before committing real money.

Attend free financial literacy workshops offered by CMA-compliant institutions.

Step 4: Diversify. Don’t put all your eggs in one basket. A balanced approach might include a mix of government securities, a few blue-chip stocks, and a SACCO long-term savings product.

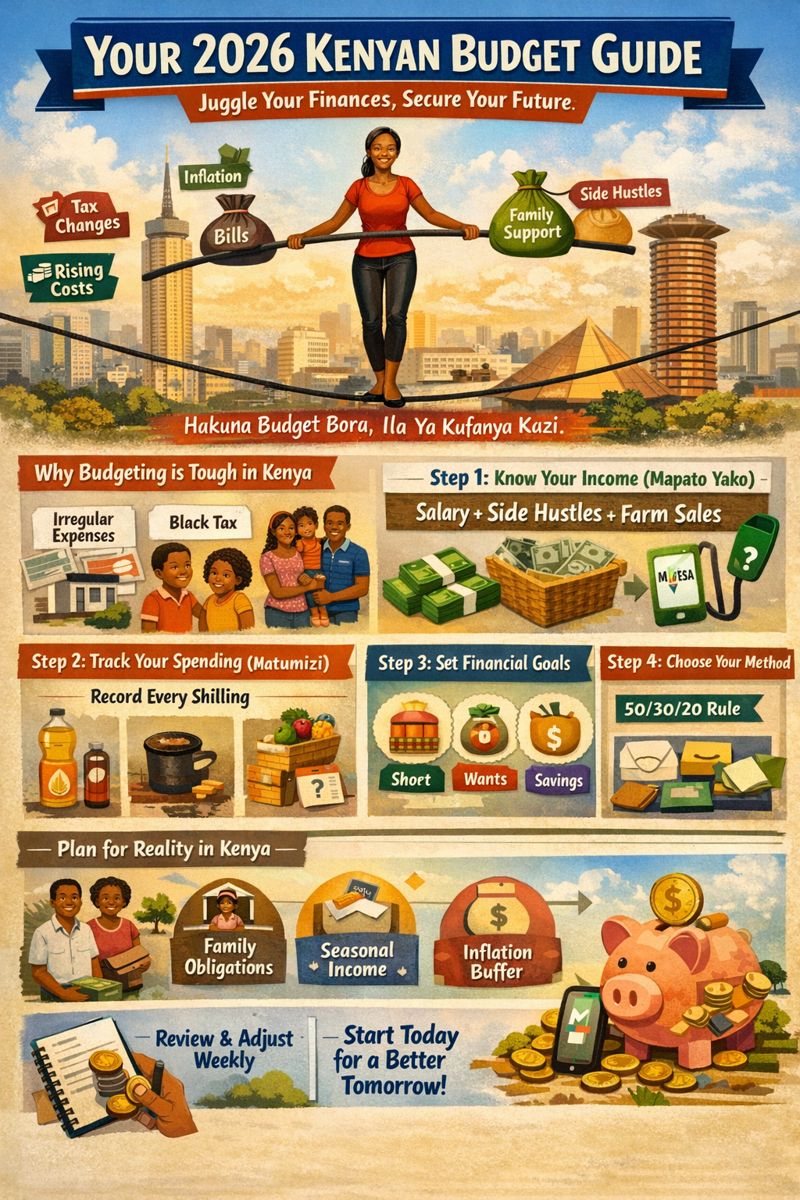

The Hybrid Approach: Doing Both Simultaneously

As your income grows, you can adopt a hybrid model. Allocate a percentage of your monthly income to mandatory savings (emergency fund top-ups, specific short-term goals) and a separate percentage to long-term investments. A common rule is the 50/30/20 budget: 50% needs, 30% wants, and 20% to savings AND investments combined. Within that 20%, prioritize your emergency savings first, then shift focus to investments.

Final Verdict: The Winning Sequence for Kenya

For anyone seeking financial stability and growth in Kenya, the path is clear: Prioritize building a disciplined savings habit to create an emergency fund first. This is your shield. Then, and only then, systematically begin investing with clear goals. This is your sword.

Starting to invest without savings is like building a house on quicksand—the first financial shock can wipe you out. By securing your foundation first, you give your investments the time and stability they need to grow, propelling you toward true financial freedom. Start today: audit your expenses, open a dedicated savings pot, and take that first powerful step. Your future self will thank you.