Living below your means is one of the most powerful financial principles you can adopt—it’s the cornerstone of building savings, reducing debt, and achieving long-term financial freedom. Yet, for many, the idea conjures images of deprivation, constant sacrifice, and a lower quality of life. The good news? It doesn’t have to feel that way. With the right mindset and strategies, you can live richly while spending less. This guide will show you how to embrace a below-your-means lifestyle without feeling poor, transforming your relationship with money and abundance.

Understanding the Mindset: It’s About Value, Not Deprivation

The first and most crucial step is reframing your perspective. Living below your means isn’t about pinching pennies until it hurts; it’s about consciously aligning your spending with your values. It's the difference between cutting back and choosing wisely.

Shift from "I can’t afford that" to "That’s not a priority for me right now." This simple language change empowers you. It moves you from a place of lack to a place of purposeful choice. Your money becomes a tool to build the life you want, not a barrier to it.

Define "Rich" for Yourself. Does "rich" mean stress-free weekends, the ability to travel spontaneously, or the security of a robust emergency fund? By focusing on the non-material wealth you’re creating—peace of mind, time freedom, security—spending less on "stuff" feels like a gain, not a loss.

Practice Gratitude. Regularly acknowledging what you do have—your health, relationships, a comfortable home—combats the scarcity mindset that makes frugality feel like poverty. Gratitude magnifies the feeling of abundance.

Strategy 1: The "Rich Life" Budget

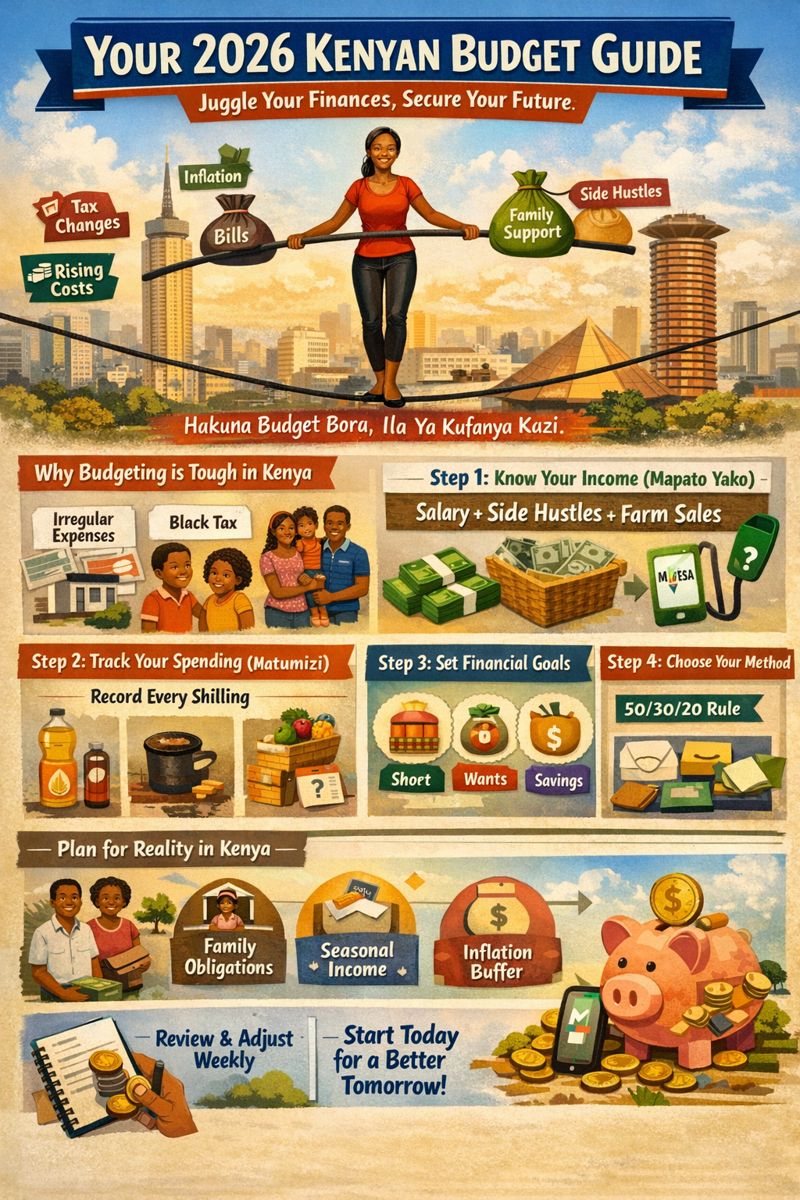

Don’t just budget to restrict; budget to create space for what matters. Use a zero-based or 50/30/20 budget framework, but with a twist: mandate a "Joy Fund."

The 50/30/20 Rule, Reimagined:

50% for Needs: Housing, utilities, groceries, basic transportation.

30% for Wants: This is where your "Joy Fund" lives. It’s a non-negotiable allocation for things that bring you genuine pleasure—a nice dinner out, a hobby, a streaming service. Protecting this fund prevents the feeling of deprivation.

20% for Savings/Debt: Future you will feel incredibly wealthy because of this.

Automate Your Wealth: Set up automatic transfers to savings and investments right after payday. If you never see the money, you can’t miss it. Watching your savings grow automatically becomes a source of pride and a tangible measure of your growing "richness."

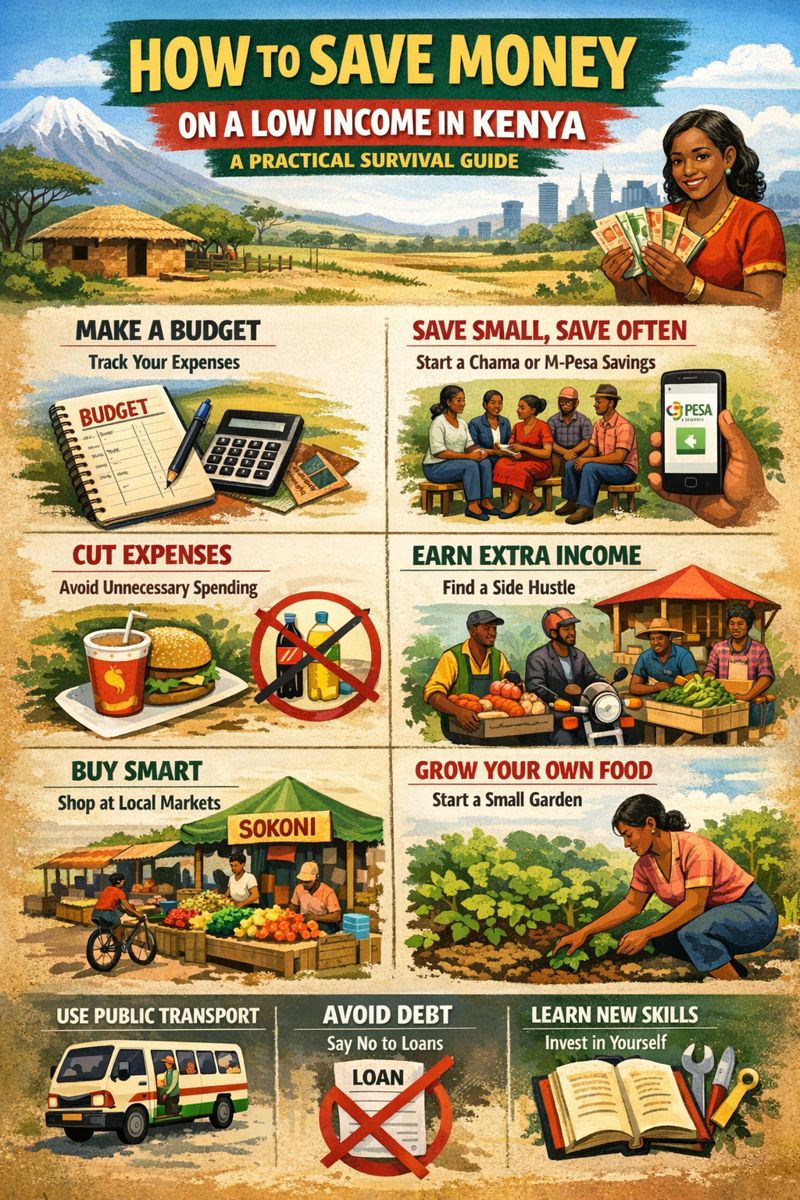

Strategy 2: Master the Art of Smart Spending

Living well on less is about maximizing value, not minimizing purchases.

The Quality-Over-Quantity Principle: Invest in fewer, higher-quality items for things you use daily (a good mattress, comfortable shoes, a reliable kitchen knife). They last longer and enhance daily life, making you feel well-cared-for.

Become a Experience Curator: Research shows experiences bring more lasting happiness than possessions. Host a potluck game night instead of an expensive dinner out. Explore free museum days, hikes, or community festivals. These create rich memories without a rich price tag.

Leverage the Library & Sharing Economy: Your local library offers free books, movies, music, magazines, and often passes to local attractions. Explore tool-lending libraries, clothing swaps with friends, or car-sharing services for occasional needs.

Strategy 3: Redefine Luxuries

You don’t have to give up luxury; you just need to redefine it in affordable terms.

Create Rituals: A luxury is often about attention and ambiance. Turn your morning coffee into a ritual with a favorite mug and a quiet moment. Give yourself a professional-style manicure at home. Light a candle for your weekly bath.

DIY Where it Brings Joy: If you find cooking therapeutic, making your own artisan bread or gourmet meals is a luxury that saves money. If you hate it, buying pre-chopped veggies is a worth-it timesaver. Focus DIY efforts on activities you genuinely enjoy.

Seek Out Affordable Elegance: Enjoy happy hours for a taste of a fancy restaurant. Visit botanical gardens or art gallery openings (often free). Buy flowers from the farmer’s market to beautify your home.

Strategy 4: Cultivate a Rich Social Life on a Budget

Fear of missing out (FOMO) is a major reason people overspend. Combat it by being the architect of your social calendar.

Be the Planner: Suggest picnics, board game nights, hiking trips, or home-cooked dinner rotations. People often crave these authentic, lower-cost connections.

Communicate with Confidence: If friends suggest expensive outings, it’s okay to say, "I’m focusing on my savings goals this month, but I’d love to host brunch next week!" True friends will respect your intentions.

Invest in Free Enrichment: Attend free lectures, join a running club, or volunteer for a cause you care about. These activities build community and personal fulfillment at little to no cost.

Strategy 5: Focus on the Payoff

Keep your eyes on the prize to fuel your motivation. The feeling of financial security is the ultimate luxury.

Visualize Your Goals: Create a vision board for your debt-free date, dream vacation, or paid-off home. This makes current choices feel strategic and exciting.

Celebrate Non-Spending Milestones: Hit a savings goal? Celebrate with a free or low-cost treat—a special homemade meal, a day in nature, etc. Acknowledge your progress.

Track Your Net Worth, Not Just Your Spending: Watching your net worth increase monthly is a powerful, positive metric that overshadows any temporary urge to splurge. It’s proof your strategy is working.

Conclusion: Living Below Your Means is the New "Living Rich"

Living below your means without feeling poor is a conscious practice in intentional living. It’s about trading mindless consumption for mindful choice, fleeting purchases for lasting security, and societal pressure for personal freedom. By shifting your mindset, budgeting for joy, spending smartly, and redefining luxury, you don’t just save money—you build a richer, more resilient, and more abundant life. The greatest wealth is not an overflowing bank account, but the profound peace of mind that comes from knowing you are in control, your future is secure, and your present is filled with chosen joys. Start today, and discover how much richer you can feel by actually spending less.