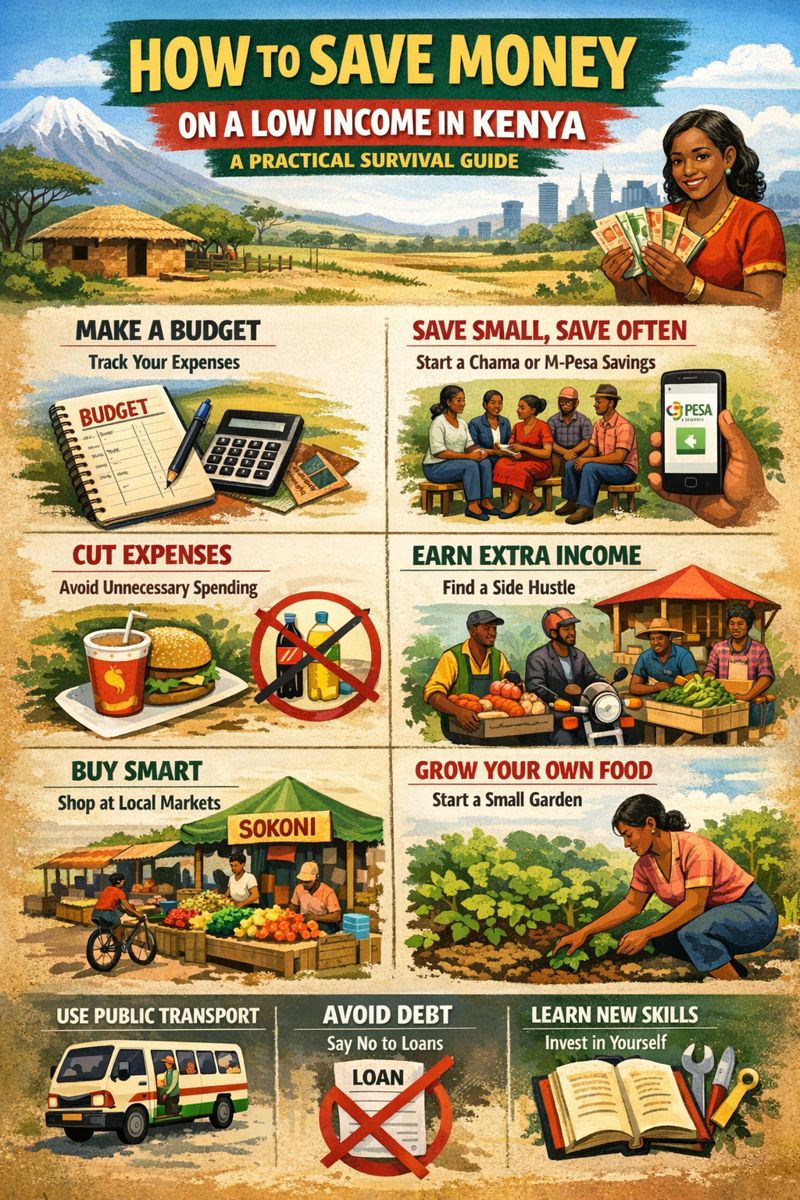

Let’s be honest: trying to save money on a low income in Kenya can feel like trying to fill a bucket with a hole in it. With the constant pressure of rising prices for unga, fuel, and school fees, the idea of setting cash aside often seems like a luxury for the rich. But here’s the powerful truth that breaks that myth: saving is not about how much you earn, but how you manage what you have. Building a financial cushion is not only possible on a low income; it is your most critical tool for escaping the cycle of living paycheck-to-paycheck. This is your actionable, no-nonsense guide to making it happen.

Mindset Shift: Your First and Most Important Shilling

Before you cut a single coin, you must change your thinking. Stop saying, “I’ll save what’s left,” and start declaring, “I pay myself first.” This means treating your savings like a non-negotiable bill—the very first “bill” you pay when you receive any money. Even if it’s only 100 Ksh, the act is transformative. It moves you from a victim of circumstances to the active manager of your finances. Track every shilling for one month using a simple notebook or a free app like Tala; you will be shocked at where the “small” money goes, and empowered to redirect it.

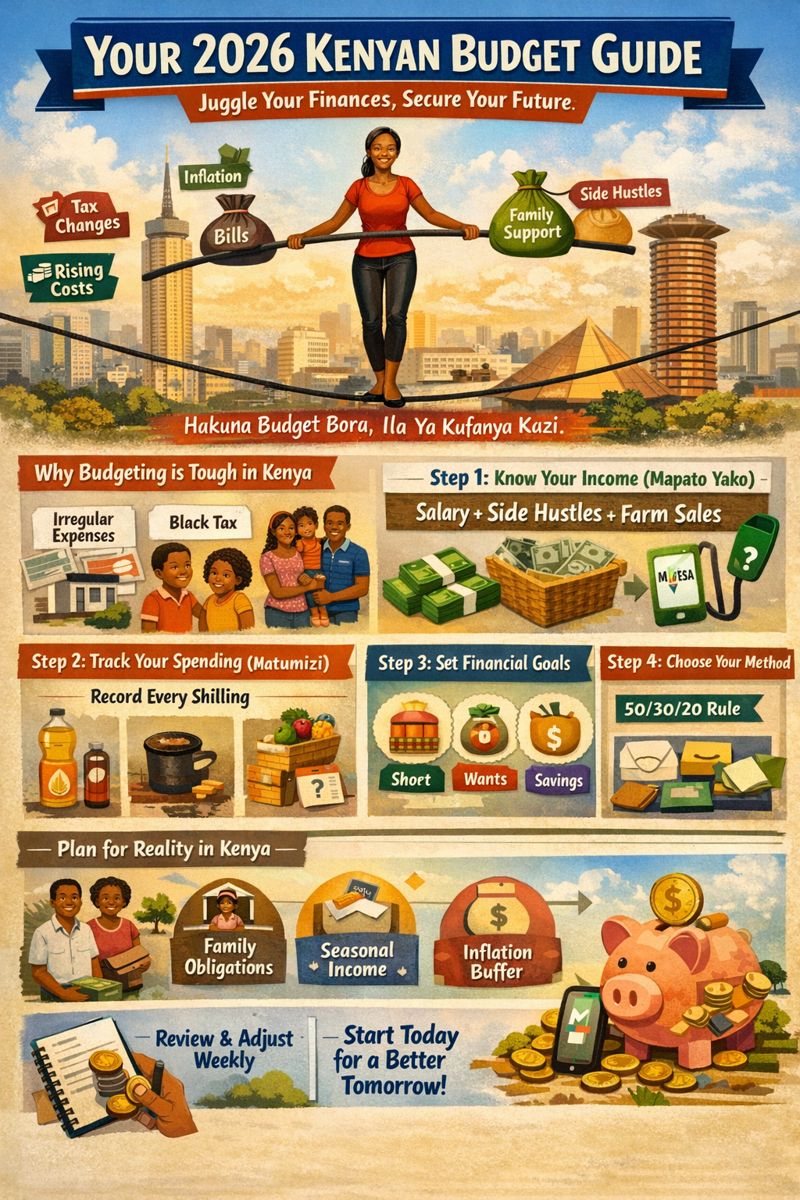

The Battle of the Budget: The 50/30/20 Rule (Kenyan Edition)

Forget complex budgets. Use this simple framework adapted for Kenya:

50% on Needs: This covers absolute essentials: rent, unga, sukuma wiki, basic utilities, and minimal transport to work. If this exceeds 50%, you must scrutinize your “needs.” Can you move to a more affordable area or share a room? Can you swap nyama for protein-rich ndengu or nduma more often?

30% on Wants: This is for matatu fare when you could walk, airtime, that occasional soda, or mchele from the kibanda instead of cooking. This category is your primary battlefield for savings. Cutting here doesn’t mean eliminating joy, but choosing it wisely.

20% on Savings & Debt Repayment: This is your “pay yourself first” goal. If 20% feels impossible, start with 5%. This money goes towards your emergency fund and paying off high-interest debt like shylocks or SACCO loans, which drain your income.

Slash Your Expenses Without Sacrificing Dignity

Here are concrete, Kenya-specific strategies:

Master the Market & Cook Smart: Avoid supermarkets for staples. Buy ugali flour, rice, and beans in bulk at the local market. Embrace seasonal vegetables (sukuma wiki is a lifesaver for a reason). Cook large batches of githeri or beans to save on fuel and time.

Ditch the “Small” Money Drains: That daily 50 Ksh for soda is 1,500 Ksh a month. That 100 Ksh for roadside chips is 3,000 Ksh. Brew your own chai. Carry a water bottle from home. These small leaks sink big ships.

Transport: Walk, Cycle, or Share: If your commute is under 5km, consider walking—it saves money and improves health. For longer distances, explore bicycle options or formalize a lift-sharing arrangement with colleagues to split fuel costs.

Airtime & Data: Switch to a SIM card with the best off-network rates. Use free Wi-Fi at work or hotspots for WhatsApp calls instead of normal calls. Buy weekly or monthly data bundles instead of daily top-ups.

The Power of Community (Chamas & SACCOs): Don’t save alone. Join a trustworthy chama (investment group). The forced contributions are a powerful saving tool, and the dividends can be significant. Consider a SACCO for disciplined saving and access to affordable loans in future, avoiding predatory lenders.

Increase Your Income: The Other Side of the Equation

Saving becomes easier when the pool is bigger. Use your skills:

The Gig Hustle: Offer services in your estate—hair plaiting, tailoring, tutoring school kids, phone repair, or baking mandazis.

Sell What You Don’t Need: Use platforms like Facebook Marketplace or Jiji to sell old clothes, phones, or furniture. Turn clutter into cash.

Use Your Phone: Explore legitimate online micro-tasking platforms that pay via M-Pesa for small online jobs.

Where to Keep Your Savings (Safely!)

Avoid the temptation of keeping it all in M-Pesa. While convenient, it’s too easy to spend. Here’s a safer pyramid:

Emergency Fund First: Aim for 5,000 Ksh, then 10,000 Ksh, hidden at home in a locked box or with a trusted family member. This is for true emergencies only.

Mobile Money Lock Savings: Use M-Shwari’s Lock Savings or KCB M-Pesa’s Goal Savings. This locks the money away for a set period, earning a little interest and preventing impulse spending.

SACCO or Bank Account: Once you have a consistent stash, open a low-fee SACCO share account or a bank savings account. They offer better interest and security.

Start Today, Not Tomorrow

Your journey begins with the next 100 shillings you receive. Envelop it, label it “MY FUTURE,” and hide it. The amount is irrelevant; the habit is priceless. In Kenya’s tough economy, your savings are not just money—they are your peace of mind, your power to say no to exploitation, and your seed for a more secure tomorrow. Stop waiting for a better salary. Deploy these strategies now, and watch your financial confidence grow, one saved shilling at a time.