Introduction: The Rise of Mobile Money and Its Risks

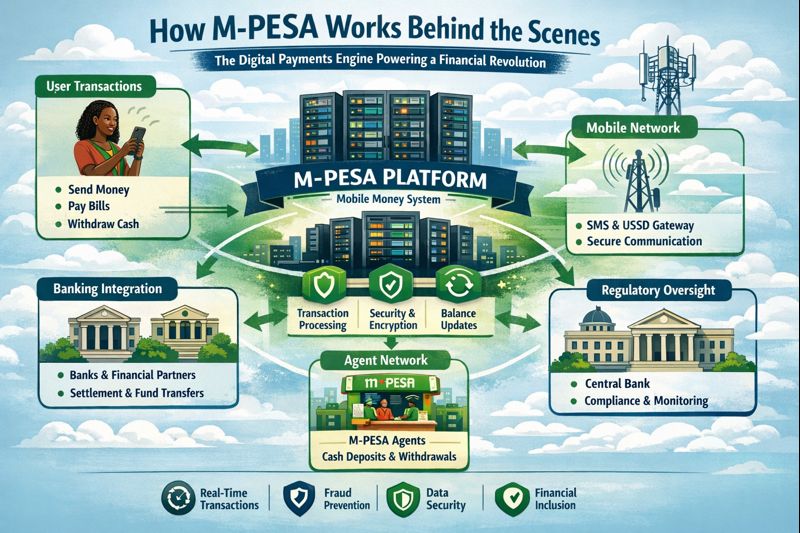

Mobile money has revolutionized financial access globally, providing banking services to millions who previously lacked them. From Africa's pioneering M-Pesa to platforms like Venmo, Cash App, and Google Pay, these services offer unprecedented convenience.

However, this rapid adoption has created a lucrative landscape for fraudsters. According to the Federal Trade Commission, reports of mobile payment fraud have increased by 300% in recent years.

Protecting yourself isn't just about avoiding inconvenience—it's about safeguarding your financial well-being in an increasingly digital world. This comprehensive guide will arm you with the knowledge and strategies needed to navigate mobile money platforms safely.

Understanding Mobile Money Fraud: Common Scams and Tactics

Before building defenses, you must recognize the threats. Mobile money fraud manifests in several sophisticated forms:

Phishing and Smishing Attacks: Fraudsters send deceptive text messages (SMS phishing or "smishing") pretending to be from your mobile money provider. These often contain urgent warnings about account suspension or unauthorized transactions, complete with convincing logos. The link directs you to a fake login page designed to harvest your credentials. A 2023 report by Proofpoint found that 84% of organizations faced smishing attacks, making it one of the most prevalent threats.

SIM Swap Fraud: In this high-stakes scam, criminals impersonate you to your mobile carrier. They convince customer support to transfer your phone number to a SIM card they control. Once they have your number, they can intercept one-time passwords (OTPs) and bypass two-factor authentication, gaining full access to your mobile money accounts. The FBI notes that SIM swap complaints have led to staggering financial losses, often targeting individuals with significant cryptocurrency holdings linked to their numbers.

Fake Agent and Customer Support Scams: Fraudsters pose as mobile money agents or official customer service representatives. They may call, message, or even set up physical stalls. Their goal is to "assist" you with a transaction or problem, ultimately tricking you into revealing your PIN, sending money to their account, or handing over your phone. In many regions, unregistered, illegal agents are a significant source of fraud.

The "Wrong Number" or "Mistaken Payment" Scam: You receive a message claiming someone accidentally sent money to your number, pleading for its return. If you comply, you send your own funds to the fraudster. Alternatively, the initial "mistaken" transfer may be from a stolen account or card, and the real victim's bank could later reverse the transaction, leaving you out of pocket.

Prize and Lottery Scams: Messages congratulate you on winning a lottery or prize, often from a well-known company. To claim your "reward," you must pay a small "processing fee" or "tax" via mobile money. After you pay, the prize never materializes, and the fraudster disappears or invents further fees.

Social Engineering and Impersonation: This involves manipulating you into taking a specific action. A caller might impersonate a family member in distress (the "grandparent scam"), a government official demanding tax payments, or a romantic interest developed online ("catfishing"). The pressure and fabricated urgency cloud judgment, leading to unauthorized transfers.

Foundational Protection: Securing Your Device and Accounts

Your first line of defense is the physical and digital security of your smartphone and accounts.

1. Use Strong, Unique Passwords and PINs: Your mobile money PIN should be a complex number that is not easily guessable. Avoid using birthdays, anniversaries, or repetitive digits (e.g., 1234, 0000). Never share this PIN with anyone—legitimate providers will never ask for it. Furthermore, use a strong, unique password for the email account linked to your mobile money profile. Enable biometric authentication (fingerprint or facial recognition) on your mobile money app if available.

2. Enable All Available Security Features: Activate every security option your provider offers:

Two-Factor Authentication (2FA): Use an authenticator app (like Google Authenticator or Authy) instead of SMS-based codes where possible to thwart SIM swap attacks.

Transaction Limits: Set daily transaction limits to minimize potential losses.

Withdrawal Whitelists: Some apps allow you to pre-authorize only specific bank accounts for withdrawals.

Instant Notification Alerts: Ensure you receive real-time SMS or push notifications for every transaction, login, and password change.

3. Keep Your Device Software Updated: Regularly update your phone's operating system (iOS or Android) and all apps, especially your mobile money app. These updates often contain critical security patches for newly discovered vulnerabilities. Enable automatic updates for maximum protection.

4. Install Reputable Security Software: Use a well-reviewed mobile antivirus and anti-malware solution. This software can detect and block malicious apps and phishing attempts before they cause harm.

5. Secure Your SIM Card: Contact your mobile network operator and set up a SIM card lock (using a PIN, different from your mobile money PIN). This prevents your SIM from being used in another device without authorization. Also, inquire about adding a "port-out" or "SIM swap" PIN—a secret passcode that must be provided before your number can be transferred.

Proactive Behavioral Practices: The Human Firewall

Technology alone isn't enough. Your habits and vigilance are crucial.

1. Verify, Then Trust: If you receive an urgent call or message claiming to be from your provider, do not engage. End the call or ignore the message. Instead, independently look up the official customer service number or website (not from the message) and contact them directly to verify the claim. Remember: Legitimate institutions will never pressure you for immediate payment or sensitive information over the phone.

2. Scrutinize All Links and Numbers: Hover over links in emails or messages (without clicking) to see the actual URL. Be wary of misspellings, unusual domains, or URLs that don't match the official provider's website. Check sender numbers; official messages often come from shortcodes, not regular 10-digit numbers.

3. Practice Discretion on Public Wi-Fi: Avoid conducting mobile money transactions on public or unsecured Wi-Fi networks (e.g., at coffee shops, airports). These networks are hunting grounds for "man-in-the-middle" attacks where fraudsters intercept data. Use your mobile data plan or a trusted, password-protected Wi-Fi connection for financial activities.

4. Be Wary of Unsolicited Offers: If an offer sounds too good to be true—a huge prize, an investment with guaranteed high returns, a desperate plea from a stranger—it almost certainly is. Delete the message and block the number.

5. Protect Your Personal Information: Be careful about what you share on social media. Details like your phone number, birth date, pet's name, or mother's maiden name can be used to answer security questions or craft convincing social engineering attacks. Adjust your privacy settings to limit public access to your personal information.

What to Do If You Suspect or Fall Victim to Fraud

Even with the best precautions, you might be targeted. Swift action is critical.

1. Immediate Steps:

Contact Your Mobile Money Provider Immediately: Call their official fraud hotline. Report the incident and request an immediate freeze or hold on your account to prevent further transactions.

Contact Your Mobile Network Operator: Inform them of a potential SIM swap attempt or if your phone has been lost/stolen. They can block your SIM.

Change Your Credentials: If you still have access, immediately change your mobile money PIN and the password for your linked email account from a secure device.

2. Document Everything: Keep detailed records: screenshots of fraudulent messages, transaction IDs, phone numbers used by the scammer, timestamps, and notes from all conversations with customer service. This creates a paper trail essential for investigations.

3. Report to Authorities: File a report with the relevant authorities. This could be your local police (especially for significant sums), national consumer protection agencies, or cybercrime units (like the FBI's Internet Crime Complaint Center in the U.S.). Reporting helps authorities track fraud trends and may aid in recovery.

4. Monitor Your Accounts and Credit: Closely monitor all linked bank accounts and credit reports for any unusual activity in the following months. Consider placing a fraud alert on your credit file.

5. Educate Others: Share your experience (without revealing overly sensitive details) with friends and family. Raising awareness helps protect your community and reduces the fraudster's success rate.

Conclusion: Empowerment Through Vigilance

Mobile money is a powerful tool for financial inclusion and convenience, but its security is a shared responsibility between providers and users. By understanding the common tactics of fraudsters, hardening your device and accounts with robust security measures, and adopting a mindset of healthy skepticism, you can dramatically reduce your risk.

Remember, the core principles are simple: guard your PIN and passwords fiercely, verify all unsolicited contact independently, and never act in haste under pressure. Stay informed, stay cautious, and you can confidently enjoy the benefits of mobile money while keeping your hard-earned funds secure. Your financial safety in the digital age starts with the choices you make today.