The financial landscape in Kenya is undergoing a revolutionary transformation. Gone are the days when investing was the exclusive domain of the wealthy, requiring bulky paperwork, intimidating minimum deposits, and frequent visits to stockbrokers.

Today, fueled by unprecedented mobile penetration, financial innovation, and a growing culture of financial literacy, building wealth is increasingly happening in the palm of your hand.

For Kenyans seeking to grow their savings, plan for retirement, or simply make their money work harder, a new generation of investment apps offers unprecedented access, control, and opportunity.

This comprehensive guide delves deep into the best investment apps available to Kenyans in 2024, analyzing their features, benefits, risks, and ideal user profiles to help you make an informed decision on your wealth-creation journey.

The Rise of the Digital Investor in Kenya

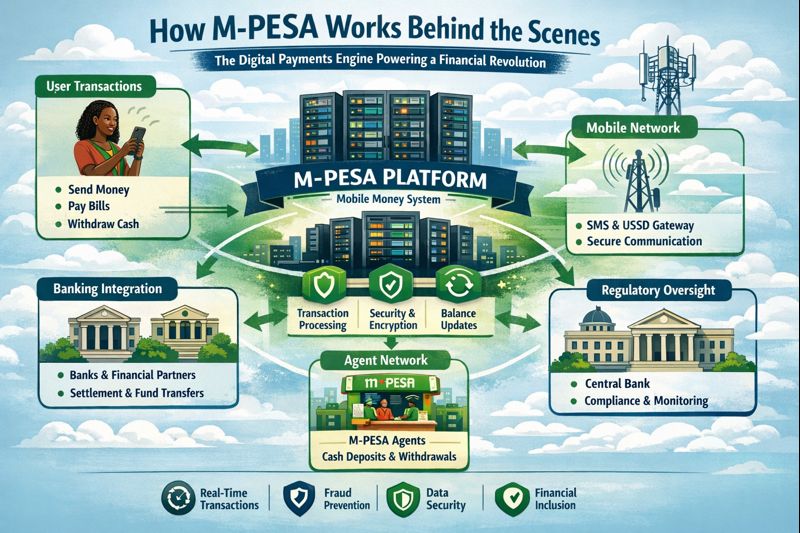

Kenya’s status as a global leader in mobile money, pioneered by M-PESA, created the perfect foundation for investment technology. A young, tech-savvy population, coupled with rising inflation and the limitations of traditional savings accounts, has created a powerful demand for alternative wealth-building tools.

Investment apps have risen to meet this demand by solving key pain points: they lower barriers to entry with minimal starting amounts, demystify complex financial concepts through user-friendly interfaces, and provide real-time access to markets that were once opaque and inaccessible.

This democratization of finance means that whether you are a salaried employee with KES 500 to spare, a freelance professional with variable income, or a student looking to start early, there is an app tailored to your financial goals.

The Central Bank of Kenya (CBK) and the Capital Markets Authority (CMA) have also played a crucial role, fostering a regulated environment that encourages innovation while striving to protect consumers, giving Kenyans greater confidence to explore digital investing.

Evaluating the Contenders: A Deep Dive into Kenya’s Top Investment Platforms

When choosing an investment app, it's critical to look beyond just the download link. Consider factors like regulatory oversight, asset classes offered, fees structure, user experience, and customer support. Here, we break down the leading platforms reshaping Kenya’s investment scene.

1. Ndovu: The All-Rounder for Modern Portfolio Building

Ndovu has rapidly emerged as a favorite for Kenyans seeking a holistic, beginner-friendly investment experience. Regulated by the CMA, Ndovu functions as a digital asset manager.

Its core appeal lies in simplicity and education. Instead of picking individual stocks, users invest in curated, diversified portfolios (called "Pacers") that range from conservative to aggressive, aligned with personal risk tolerance and goals like retirement, education, or wealth accumulation.

The app’s sleek interface allows for seamless one-time or recurring deposits directly from M-PESA or bank accounts, making disciplined investing effortless. A standout feature is its fractional investing capability, enabling users to own a piece of expensive assets like Amazon or Tesla with very little capital.

For Kenyans new to the markets, Ndovu’s educational content and transparent fee structure (a management fee on assets) remove much of the intimidation factor, providing a guided path into global and local markets.

2. eToro (Global Platform with Local Access): The Social Trading Powerhouse

While not a Kenyan company, eToro’s global reach and unique features make it a compelling option for more engaged investors. Regulated by top-tier authorities like CySEC and the FCA, eToro is accessible to Kenyans and is famous for pioneering social trading.

This feature allows users to view the portfolios of successful investors worldwide, analyze their strategies, and even automatically copy trade them. This mirrors their trades in your own account proportionally, a powerful tool for learning and potential portfolio growth. eToro offers a vast universe of assets: thousands of global stocks (again, with fractional investing), cryptocurrencies, ETFs, and commodities.

However, its complexity and the volatility of available assets mean it’s better suited for Kenyans who have some market understanding or are keen to learn in a dynamic, community-driven environment. Users must also be mindful of currency conversion fees and the risks inherent in copy trading.

3. SokoWatch by SIB (Formerly Wazawazi): Democratizing the Nairobi Securities Exchange (NSE)

For Kenyans specifically interested in owning a direct piece of the local economy, SokoWatch by Stanbic Investment Bank is a game-changer. This CMA-regulated app provides direct, affordable access to the Nairobi Securities Exchange (NSE).

It allows users to buy and sell shares in Kenyan blue-chip companies like Safaricom, KCB, and EABL with ease. The app demystifies the NSE process, offering real-time data, company research, and a straightforward onboarding.

Its major advantage is control and direct ownership; you are a registered shareholder of the companies you invest in. This makes it ideal for Kenyans with a long-term belief in the growth of Kenyan enterprises, those interested in earning dividends, or anyone wanting to balance a global portfolio with local assets. The fee structure is typically a small brokerage commission per trade.

4. Bamboo: Gateway to U.S. and Nigerian Markets

Bamboo caters to the Kenyan investor looking for robust access to international markets, particularly the United States and Nigeria. Also regulated by the SEC in Nigeria and making strides in Kenya, Bamboo provides a secure platform to trade stocks and ETFs listed on U.S. exchanges. Like its peers, it offers fractional shares, allowing investment in high-value U.S. tech stocks.

Its focus on these two specific markets is its strength, offering in-depth research and tools for these regions. For Kenyans with an eye on the dynamism of the U.S. economy or specific interests in Nigerian companies, Bamboo provides a dedicated and streamlined conduit. As with any international platform, understanding the tax implications (like potential U.S. withholding tax on dividends) and deposit/withdrawal processes is key.

5. Binance & Paxful: The Cryptocurrency Specialists

No discussion of modern investment apps in Kenya is complete without acknowledging cryptocurrency platforms. Binance, a global giant, offers an overwhelming array of crypto trading pairs, futures, staking, and savings products.

Paxful (though its peer-to-peer marketplace has evolved) pioneered easy crypto access via M-PESA. These platforms are for a specific asset class: digital currencies like Bitcoin and Ethereum.

Investing here is highly speculative and carries significant risk due to extreme volatility and regulatory uncertainties. However, for Kenyans comfortable with high risk, seeking portfolio diversification, or interested in blockchain technology, they are essential tools. It is paramount to use these with extreme caution, invest only what you can afford to lose, and prioritize security (using two-factor authentication and hardware wallets for large amounts).

6. Chaka: Bridging African and Global Markets

Chaka’s proposition is powerful: a single platform to access both global markets (U.S. stocks and ETFs) and African exchanges, starting with Nigeria. For the pan-African investor in Kenya, this offers a unique consolidation.

You can build a portfolio that includes Tesla, a Nigerian banking stock, and a U.S. ETF tracking the S&P 500. This diversification across economies and currencies can be a potent hedge. Chaka emphasizes education and partnerships with local fintechs to deepen its reach. Its suitability lies with Kenyans who have a continental investment outlook and want to simplify managing a geographically diversified portfolio within one app.

Critical Factors Every Kenyan Investor Must Consider Before Downloading

A. Security and Regulation: Your First Priority

Before funding any app, verify its regulatory status. In Kenya, platforms dealing in local securities should be licensed by the Capital Markets Authority (CMA). Global platforms should hold licenses from reputable bodies like the FCA (UK), CySEC (Cyprus), or SEC (US). Check the app’s website for these details. Additionally, ensure the app uses bank-level security: 256-bit SSL encryption for data and two-factor authentication (2FA) for logins. Your money and data security are non-negotiable.

B. Understanding the Fee Structure: The Silent Return-Killer

All apps make money, but how they do it impacts your net returns. Scrutinize:

Trading Commissions: Fee per buy/sell order (common on brokerage apps like SokoWatch).

Spread Costs: The difference between buy and sell prices (common in forex and crypto).

Management Fees: An annual percentage of your assets under management (AUM), common on robo-advisors like Ndovu.

Inactivity or Withdrawal Fees: Charges for dormant accounts or cashing out.

Deposit/Currency Conversion Fees: Especially critical for international apps funding in USD. A low-commission app with high forex fees can be costly.

C. Defining Your Investor Profile: Know Thyself

Your choice of app should mirror your financial personality:

The Beginner/The Passive Investor: Prioritizes ease, education, and automated diversification. Best Fit: Ndovu.

The Active Trader/The Learner: Enjoys researching, picking assets, and engaging with a community. Best Fit: eToro.

The Local Market Believer: Wants direct ownership and dividends from Kenyan companies. Best Fit: SokoWatch by SIB.

The Global/Continental Diversifier: Seeks specific exposure to U.S., Nigerian, or pan-African assets. Best Fit: Bamboo or Chaka.

The Crypto-Curious Speculator: Understands and accepts high risk for potential high reward in digital assets. Best Fit: Binance (with extreme caution).

D. Starting Small & Embracing Consistency

The most powerful tool in investing is not picking the hottest stock—it’s consistent discipline. Most apps allow you to start with as little as KES 100 or KES 500. Utilize features like automated recurring deposits to build an investment habit. This strategy, known as shilling-cost averaging, involves investing a fixed amount regularly, which buys more units when prices are low and fewer when they are high, smoothing out market volatility over time.

Navigating Risks and Building a Sustainable Strategy

Investing is not a guaranteed path to quick riches; it is a long-term marathon. All investments carry risk, including the potential loss of principal. Market values fluctuate. Diversification—spreading your investments across different asset classes (stocks, bonds, real estate via REITs) and geographies—is your primary defense against risk. Avoid putting all your capital into a single company or, especially, a single volatile cryptocurrency.

Furthermore, view investing as a complement to, not a replacement for, a solid financial foundation. Ensure you have an emergency fund (typically 3-6 months of expenses) in a liquid savings account before committing large sums to investments. Continuously educate yourself using the resources provided by these apps and other reputable financial educators in Kenya.

Conclusion: Your Financial Future is at Your Fingertips

The array of investment apps available to Kenyans today represents a profound shift towards financial inclusion and empowerment. From the guided, portfolio-based approach of Ndovu to the direct market access of SokoWatch and the global reach of eToro and Bamboo, there has never been a better time to start your investment journey.

The "best" app is not a universal title but a personal fit—the one that aligns with your goals, risk appetite, and level of engagement. By prioritizing security, understanding costs, starting small, and investing consistently, you can leverage these powerful digital tools to navigate inflation, build meaningful wealth, and secure your financial future, one tap at a time.

Take the first step today: download an app, explore its features with a demo account if available, and begin the rewarding journey of becoming an active participant in your own economic destiny.