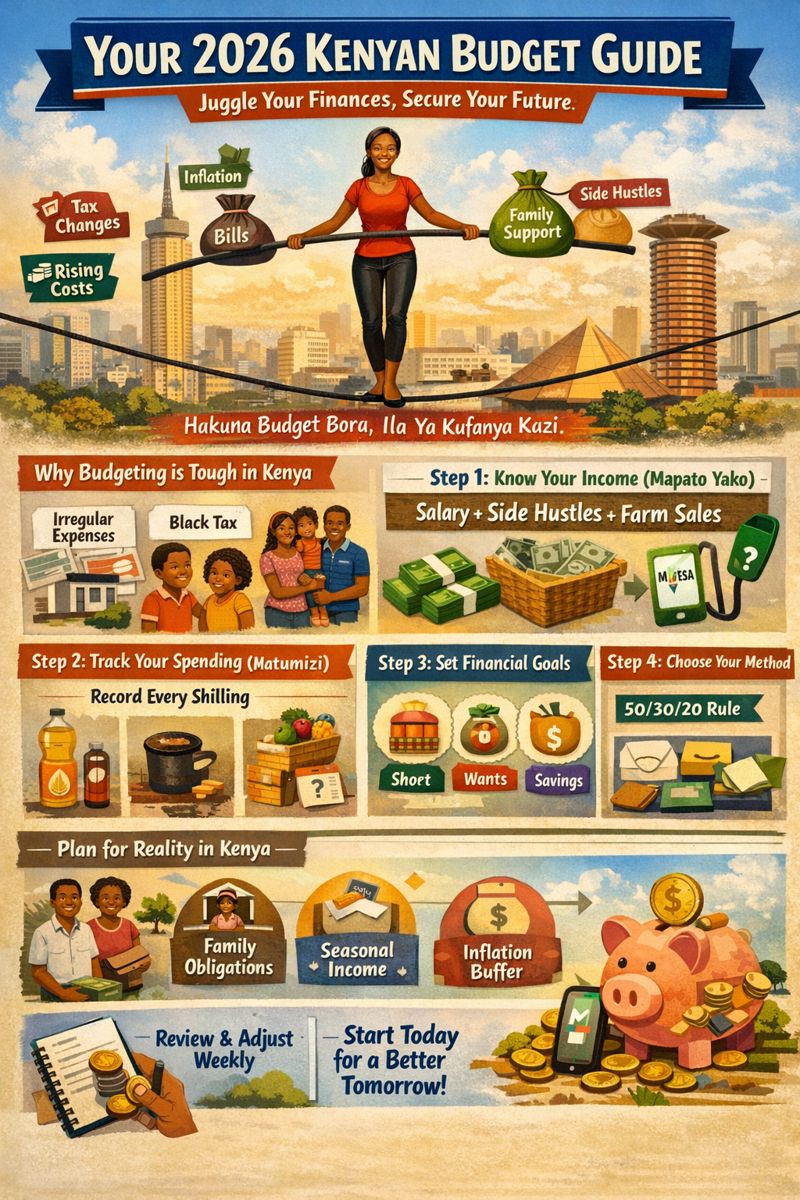

In the dynamic economic landscape of Kenya, managing personal finances can feel like a constant balancing act. With inflation, shifting tax policies, and the ever-present need to save for the future, creating a budget that actually works is not just a good idea—it's a necessity for financial stability and peace of mind. As we move into 2026, new opportunities and challenges shape the way Kenyans earn, spend, and save. This comprehensive guide will walk you through a practical, culturally relevant, and effective step-by-step process to build a budget that sticks and helps you achieve your financial goals in Kenya.

Why Budgeting Feels Difficult & How to Overcome It in the Kenyan Context

Many Kenyans start budgeting with enthusiasm only to abandon it after a few months. Common pitfalls include:

Underestimating Irregular Expenses: School fees in January, NHIF payments, car insurance, and holidays like Christmas are predictable but often forgotten in monthly plans.

The "Black Tax" & Family Obligations: Unplanned financial requests from extended family can derail even the most detailed budget.

Inconsistent Income: For those in informal employment, gig work, or farming, income isn't always a fixed monthly salary.

Rising Cost of Living: Prices for basic commodities like unga, cooking oil, and fuel can shift, making fixed allocations unrealistic.

All-or-Nothing Mindset: One overspend leads to the feeling the whole budget is ruined.

The key is to create a flexible, realistic, and Kenyan-centric budget, not a restrictive one.

Step-by-Step: Building Your 2026 Kenyan Budget

Step 1: Know Your Income (Mapato Yako)

List all sources of net income (after deductions like PAYE, NSSF, NHIF).

Formal Salary: Your take-home pay.

Side Hustles: M-Pesa from your online business, freelance work, or weekend gig.

Rental Income: Net of any agent fees or maintenance.

Farm Produce Sales: Estimate an average monthly value.

For Irregular Income: Calculate a conservative 3-6 month average.

2026 Insight: With the growth of digital platforms and the gig economy, ensure you account for all streams. Remember to set aside a percentage for taxes if your side hustles are not tax-withheld at source.

Step 2: Track Every Shilling of Your Spending (Matumizi)

For one month, diligently record every expense. Use a notebook, Notes app, or budgeting apps like Money Manager or YNAB. Categorize them:

Fixed Needs: Rent/Mortgage, Loan Repayments (Hustler Fund, Bank loans), Basic Utilities (Electricity, Water, Internet), School Fees, Mandatory Savings (e.g., SACCO contributions).

Variable Needs: Groceries (including mtumba), Transport (fuel, matatu fare), Airtime & Data, Household items.

Wants: Eating out (KFC, Artcaffe), Entertainment (Showmax, Netflix), New clothes beyond basics, Weekend getaways.

Obligations & Future: "Black Tax"/Family Support, Emergency Fund, Investment, Retirement (e.g., Voluntary NSSF), Insurance (Bima).

Step 3: Set Smart, Kenyan-Inspired Financial Goals

Your budget needs a purpose. Define goals for 2026:

Short-Term (1 Year): Save Ksh 50,000 for a new laptop, clear a Fuliza balance, or take a family trip to Diani.

Mid-Term (1-5 Years): Save for a plot deposit, buy a car, or start a capital-intensive business.

Long-Term (5+ Years): Fund your child's university education, build your retirement home, or achieve financial independence.

Step 4: Choose Your Budgeting Method

Select a framework that suits your Kenyan lifestyle:

The 50/30/20 Rule (Adjusted for Kenya):

50% on Needs: This may be higher in urban areas like Nairobi due to rent. Adjust as needed.

30% on Wants: Control this to boost savings.

20% on Savings & Debt Repayment: Prioritize building an emergency fund first.

The Envelope System (Digital or Cash):

Allocate cash for variable categories (like groceries, transport) into physical envelopes. In 2026, use M-Pesa Paybill or Till Numbers for this: Create separate saving pots for "Rent," "School Fees," "Fun Money" using M-Pesa's lock savings feature or your bank's goal-based savings accounts.Zero-Based Budget:

Give every shilling a job until your income minus expenses equals zero. This includes allocating money to savings and investments as "expenses."

Step 5: Plan for the Kenyan Reality

The "Black Tax" Budget Line: Don't see it as an irregular expense. Allocate a specific, affordable amount monthly for family support. Politely but firmly communicate this boundary.

Harvest & Seasonality: If you're an agribusiness entrepreneur, budget annually. Divide annual income by 12, but save heavily during harvest months to cover lean periods.

Inflation Buffer: Add a 10-15% buffer to your variable needs categories (like groceries) to absorb price hikes.

Emergency Fund: This is non-negotiable. Aim for 3-6 months of expenses in a liquid SACCO or Money Market Fund account. Start with a goal of Ksh 20,000, then build.

Step 6: Use Technology (2026 Tools)

Leverage Kenyan financial technology:

M-Pesa: Use it for tracking (statements), budgeting (saving pots), and disciplined spending.

Banking Apps: Set up automatic transfers to savings accounts on payday.

Budgeting Apps: Try Walletry, MoneyHash, or Spendee to sync and categorize expenses.

SACCO Apps: Manage your disciplined, high-interest savings conveniently.

Step 7: Review, Adjust, and Stay Disciplined Weekly

Set a weekly "finance date" to:

Track spending against your plan.

Adjust next week's allocations if you overspent in one category.

Celebrate small wins! Stuck to your grocery budget? Treat yourself modestly.

Sample Monthly Budget for a Nairobi Professional (2026 Estimates)

| Category | Amount (Ksh) | Notes |

|---|---|---|

| INCOME | 85,000 | |

| NEEDS (55%) | 46,750 | |

| Rent | 20,000 | 1-Bedroom in outer estate |

| Utilities (Power, Water, Wi-Fi) | 4,500 | |

| Groceries & Household | 12,000 | Includes mtumba basics |

| Transport (Fuel/Matatu) | 8,000 | |

| NHIF & Basic Medical | 1,500 | |

| Airtime & Data | 2,500 | |

| SAVINGS & DEBT (20%) | 17,000 | Pay yourself first! |

| Emergency Fund | 5,000 | Transfer immediately on payday |

| SACCO Contribution | 7,000 | For future loans/chama contributions |

| Hustler Fund/Loan Repayment | 5,000 | |

| WANTS & OBLIGATIONS (25%) | 21,250 | |

| Family Support | 7,000 | A fixed, manageable amount |

| Eating Out & Entertainment | 6,000 | |

| Personal Care | 3,000 | Salon, etc. |

| Subscriptions (Showmax, etc.) | 1,500 | |

| Miscellaneous / Buffer | 3,750 | For unplanned spends or to boost savings |

| TOTAL | 85,000 | Income - Expenses = 0 |

Final Tips for Success in 2026

Involve Your Spouse/Partner: Financial harmony is crucial. Budget together.

Beware of "Aje Sherehe" Culture: Peer pressure can break a budget. Learn to enjoy within your means.

Automate Finances: Set standing orders for savings and fixed bills to avoid temptation.

Celebrate Milestones: Reached a savings goal? Reward yourself modestly to stay motivated.

Be Patient & Kind to Yourself: Budgeting is a skill. You will make mistakes. Adjust and continue.

Creating a budget that works in Kenya is about understanding your unique financial flow, respecting your cultural obligations, and leveraging tools to plan for the future. As we navigate 2026, take control of your shilling. Start today—not with perfection, but with a simple pen, paper, and a commitment to a more secure and prosperous financial future. Your peace of mind is worth every effort.

Hakuna Budget Bora, Ila Ya Kufanya Kazi. (There's no perfect budget, just one that works.)

About the Author

This article was written by the KenyaHowTo editorial team. Our mission is to provide practical, reliable information about living, working, and thriving in Kenya.