Introduction: The Modern Debt Dilemma

In today's consumer-driven economy, access to credit has never been easier. With a few clicks, you can secure a personal loan, finance a car, or accumulate credit card debt for everything from daily expenses to luxury purchases.

While borrowing can be a powerful tool for achieving life goals—like purchasing a home, funding education, or starting a business—it carries significant risks when mismanaged.

Over-borrowing, the practice of taking on more debt than one can reasonably repay, has become a silent epidemic affecting millions globally. It can lead to financial stress, damaged credit scores, bankruptcy, and long-term economic hardship. This comprehensive guide will explore practical, actionable strategies to help you navigate the credit landscape wisely, recognize warning signs, and build a sustainable financial future free from the burdens of excessive debt.

Understanding Over-Borrowing: More Than Just Numbers

Before addressing solutions, we must define the problem. Over-borrowing occurs when your debt obligations surpass your ability to repay them comfortably within standard terms. It's not solely about total dollar amounts but about the relationship between debt, income, and financial resilience.

Key indicators of over-borrowing include:

Debt payments exceeding 36-40% of your gross monthly income

Routinely making minimum payments on credit cards

Using new loans to pay off existing debts

Having no emergency savings while maintaining debt balances

Experiencing constant anxiety about money and due dates

Receiving calls from collectors or facing threats of repossession

Psychological drivers often fuel over-borrowing, including lifestyle inflation, social pressure, impulsive spending, and using credit to cope with emotional distress. Recognizing these behavioral patterns is the first step toward change.

Foundation: Cultivating a Mindset of Financial Intentionality

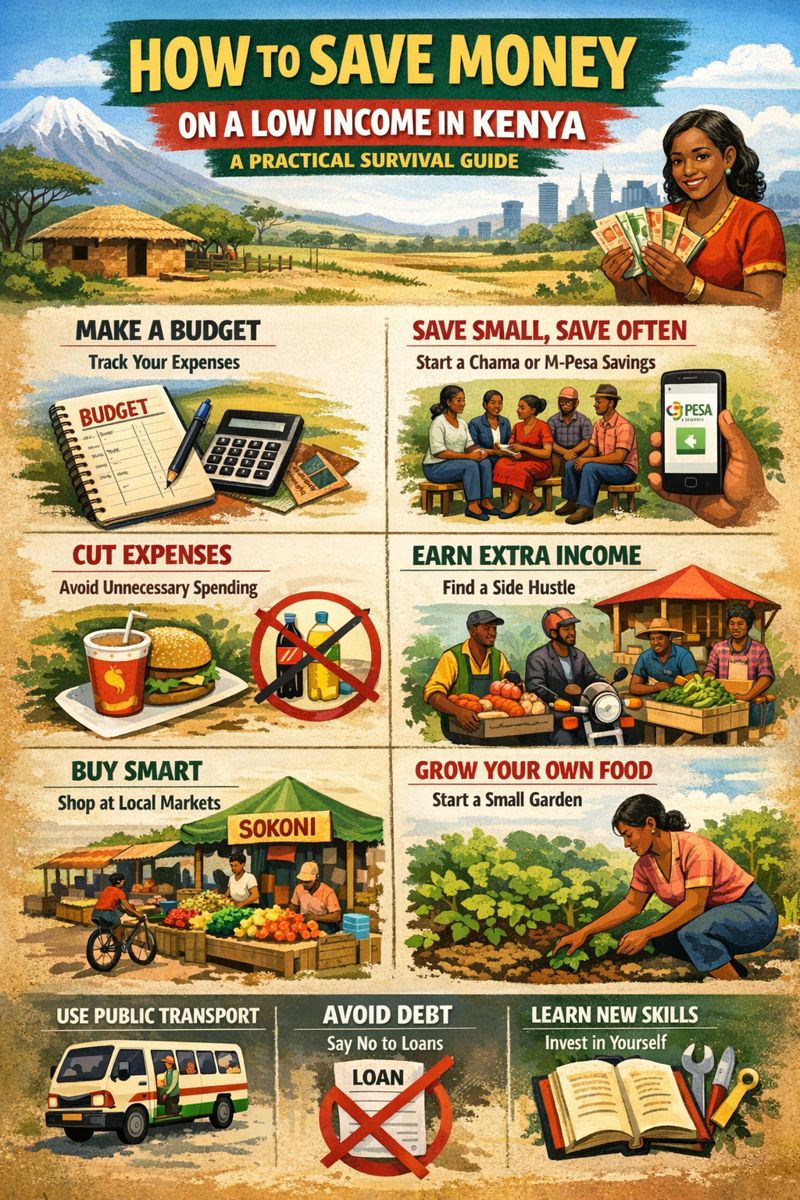

Avoiding over-borrowing begins not with spreadsheets, but with mindset. Shift from a consumption-oriented outlook to one of intentional financial stewardship.

Practice Conscious Spending: Before making any significant purchase—especially on credit—implement a mandatory waiting period. For expenses over a predetermined amount (e.g., $100 or $500), institute a 24-to-48-hour rule. This pause disrupts impulsive borrowing and allows for logical evaluation of necessity versus desire.

Define "Needs" vs. "Wants" Rigorously: A "need" is something required for basic safety, health, or livelihood. A "want" enhances life but is not essential. Borrowing should be heavily skewed toward needs and carefully considered, strategic wants (like a responsible mortgage for a home).

Embrace Contentment and Delayed Gratification: Our culture often equates more spending with more happiness. Actively practice gratitude for what you have and develop hobbies that don't rely on consumption. Train yourself to save for goals rather than finance them immediately with debt.

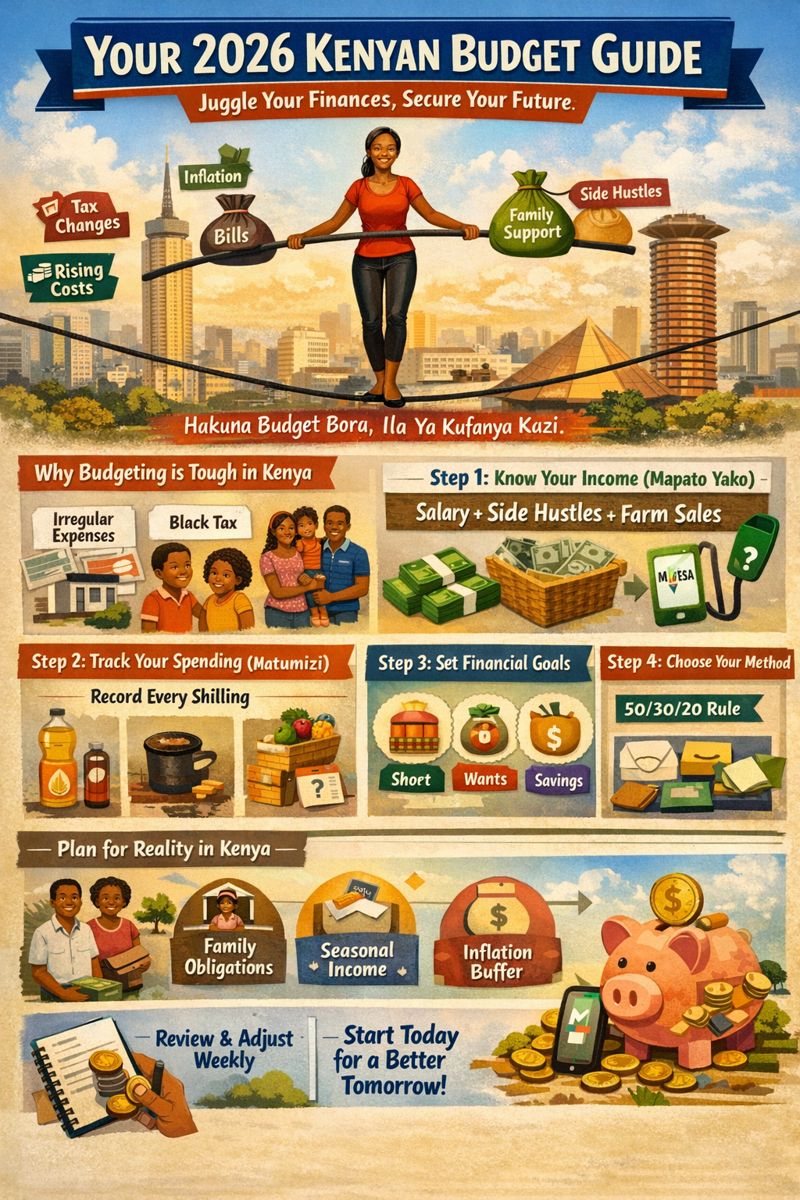

The Bedrock of Borrowing: Your Personal Financial Dashboard

You cannot manage what you do not measure. Create a clear, accurate picture of your finances before considering any new debt.

Calculate Your Debt-to-Income (DTI) Ratio: This is a critical metric lenders use and you should monitor diligently. Add up all monthly debt payments (mortgage/rent, car loans, student loans, credit card minimums, etc.) and divide by your gross monthly income. A DTI over 36% signals danger; strive to keep it below 28%. This is your primary borrowing speed limit.

Audit Your Cash Flow: For one to three months, track every dollar earned and spent. Categorize expenses to identify leaks and non-essential spending. This reveals your true disposable income—the money actually available to service new debt.

Know Your Net Worth: List all assets (savings, investments, property) and subtract all liabilities (debts). A negative or declining net worth is a glaring red flag that borrowing is undermining your financial foundation.

Check Your Credit Report Regularly: Obtain free annual reports from major bureaus. Your credit score is a direct result of your borrowing behavior. A falling score can indicate over-leverage and will make future borrowing more expensive.

Strategic Principles for Responsible Borrowing

When debt is necessary or strategically advantageous, apply these principles to stay in control.

1. The Purpose Test: Only Borrow for Appreciating or Essential Assets

Good Debt: Invests in your future earning potential or an asset that grows in value. Examples include student loans for a degree with strong ROI, a mortgage for a primary residence, or a business loan for a viable venture.

Bad Debt: Finances depreciating assets or transient consumption. Examples include car loans (cars lose value), credit card debt for vacations, clothing, or dining, and high-interest payday loans.

Rule: Minimize or eliminate "bad debt." For "good debt," still ensure the terms are favorable and the investment is sound.

2. The 20/10 Rule (A Practical Guideline):

Mortgage Rule: Your total household mortgage debt should not exceed 20% of your take-home pay (some experts use gross income; be conservative).

Non-Mortgage Debt Rule: Total payments on all other loans (car, credit card, personal, student) should not exceed 10% of your take-home pay.

This rule provides a simple, effective guardrail to prevent over-extension.

3. Stress-Test Every Loan: Before signing, model worst-case scenarios.

What if your income drops by 20%?

What if you face an unexpected $1,000 expense?

Could you still make payments? If the answer is no, the loan is too large.

4. Prioritize Down Payments: The larger your down payment, the less you borrow, the lower your payments, and the less interest you pay. For major purchases like homes and cars, saving for a substantial down payment (20% or more) is one of the most powerful anti-over-borrowing tactics. It also helps you avoid costly Private Mortgage Insurance (PMI) on homes.

5. Shun "Easy Money" and Predatory Lending: Be wary of "no-credit-check" loans, rent-to-own schemes, and payday lenders. Their exorbitant interest rates (often 300% APR or more) are designed to trap borrowers in a cycle of debt. If these seem like your only option, it's a sign you need to address underlying budget issues, not take on more debt.

Defensive Tactics: Building Barriers Against Over-Borrowing

Create systems that make over-borrowing difficult.

Limit Credit Access: Do not carry all your credit cards. Keep one for planned expenses and secure the rest at home. Reduce your credit limits if you find them tempting. Unsubscribe from store credit card offers and marketing emails that promote spending.

Automate Savings, Not Payments: While automating debt payments is good, prioritize automating savings transfers to an emergency fund first. Pay yourself before you have a chance to spend or borrow. Aim for 3-6 months of essential expenses.

Implement a "Debt Approval" Committee: For couples, require mutual agreement for any new debt. For individuals, establish a personal rule requiring a 48-hour review period and a written justification for any loan or major credit purchase.

Use Cash or Debit for Daily Spending: For categories where overspending is easy (dining, entertainment, shopping), use the envelope system or a dedicated debit card. This creates a tangible spending limit that credit circumvents.

The Credit Card Conundrum: A Special Section

Credit cards are the primary gateway to over-borrowing for many. Use them as a tool, not a crutch.

Pay the Statement Balance in Full, Every Month: This is non-negotiable for avoiding high-interest debt. If you cannot do this, stop using cards until you can.

Utilization Rate: Keep your credit card balances below 30% of your total credit limit at any given time. Maxing out cards hurts your credit score and is a clear over-borrowing signal.

Avoid Cash Advances: They typically have higher interest rates and no grace period—interest starts accruing immediately.

Choose Cards for Benefits, Not Bonuses: Select a card for its long-term utility (like a simple cash-back card) rather than chasing sign-up bonuses that may encourage spending to hit thresholds.

Advanced Strategies: Debt Management and Recovery

If you're already feeling stretched, act immediately.

1. The Debt Avalanche vs. Debt Snowball Methods:

Avalanche: List debts by interest rate (highest to lowest). Pay minimums on all, then put extra funds toward the highest-rate debt. This is mathematically optimal, saving the most on interest.

Snowball: List debts by balance (smallest to largest). Pay minimums on all, then knock out the smallest debt first. The psychological win of paying off an account can provide powerful motivation.

Choose the method that best fits your psychology and stick to it.

2. Debt Consolidation—Proceed with Caution: Consolidating multiple high-interest debts into a single, lower-interest loan can simplify payments and reduce cost. However, this is only beneficial if you:

Get a significantly lower interest rate.

Close or stop using the paid-off credit accounts.

Do not view the newly freed credit as an excuse to borrow more.

Understand the terms (watch for transfer fees or promotional rates that skyrocket later).

3. Communicate with Lenders: If you're struggling, contact lenders before missing payments. Many have hardship programs that can temporarily reduce payments or interest rates.

4. Seek Professional Help: Non-profit credit counseling agencies (like those affiliated with the National Foundation for Credit Counseling) can provide free budget reviews and may help set up a Debt Management Plan (DMP) to negotiate with creditors on your behalf.

Long-Term Wealth Building: The Ultimate Goal

The true purpose of avoiding over-borrowing is to free up resources for building security and wealth.

Redirect Former Debt Payments: Once a debt is paid off, immediately redirect that monthly payment amount to savings or investments. This harnesses the "power of cash flow" you've disciplined yourself to manage.

Build Multiple Income Streams: Reduce reliance on a single salary. Explore side hustles, freelance work, or passive income investments. More income provides a larger buffer against the need to borrow.

Invest in Financial Education: Continuously learn about personal finance, investing, and economics. Knowledge is your best defense against poor financial decisions and predatory practices.

Conclusion: Your Journey to Financial Freedom

Avoiding over-borrowing is not about living a life of deprivation. It is about exercising choice, power, and foresight with your money. It's about aligning your spending and borrowing with your deepest values and long-term aspirations—whether that's owning a home, traveling the world, funding your children's education, or retiring with dignity.

By cultivating the right mindset, rigorously assessing your financial health, adhering to strategic borrowing principles, and building robust defensive systems, you can use credit as the tool it was meant to be.

You can walk the line between leveraging opportunities and falling into a trap. Remember, financial freedom is not defined by the amount of credit you can access, but by the peace of mind that comes from living within your means, on your own terms, and building a legacy unburdened by debt.

Start today. Review one financial statement. Calculate your DTI. Make one decision that prioritizes long-term stability over short-term convenience. Your future self will thank you for the discipline and clarity you cultivate now. The path to a life free from the anxiety of over-borrowing is built one intentional, informed decision at a time.